Table of Contents

ToggleWhere to Invest Money in India (2026): 5 Safe & Inflation-Proof Investment Options for Salaried People

I came home after school, calm and relaxed, with a hot cup of chai in hand. Since 2009, I’ve made it a habit to read Mutual Fund Insight, Outlook Money, and similar guides to stay sharp about where to invest money in India.

Back in 1995, during college, managing rent, food, and notebooks with just ₹500 a month was possible. Today, that same ₹500 barely covers a single lunch. Times have changed—expenses keep rising, and saving alone is no longer enough.

Just then, Dhruv asked me, “Papa, you’ve been reading about money for years… but tell me, where should we invest money in India so it actually grows?”

That simple question captures what every teacher and middle-class family is thinking as we approach 2026. Traditional savings feel safe, but they often fail to beat inflation. Real financial security now comes from choosing inflation-beating, long-term investments that balance safety with growth. In this guide, I’ll explain the most practical options that help protect your money and build wealth over time.

If you’re exploring such choices, I’ve explained them in detail here: Safe Investments in India with High Returns.: Safe Investments in India with High Returns.

.

This story shares general money lessons for teachers and families, not personalized financial advice

Why Beating Inflation Matters

The biggest enemy of our money isn’t poor spending—it’s inflation. It quietly reduces the value of our savings every year. For teachers and middle-class families, the message is simple: if your money doesn’t grow faster than inflation, you’re losing purchasing power.

For example, earning 4% returns when inflation is around 5.5% means your money is shrinking in real terms. Fixed deposits and savings accounts may feel “safe,” but after tax, they often fail to protect long-term value. That’s why keeping all savings in traditional options can feel like safely losing money.

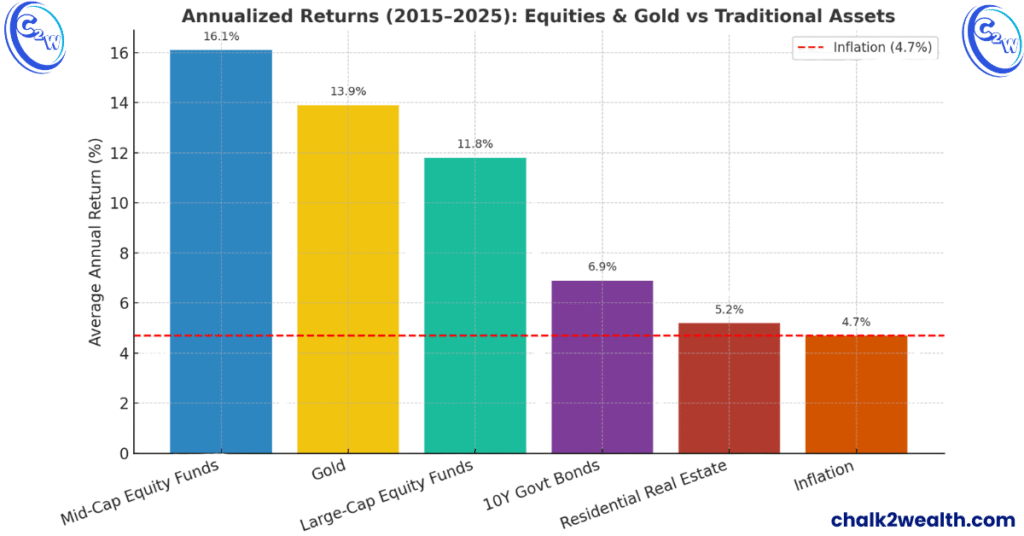

Over the last decade (2015–2025), inflation in India averaged around 4.7%. During the same period, equities and gold delivered double-digit annual returns, clearly outperforming inflation. Mid-cap equity mutual funds averaged about 16.1%, gold around 13.9%, and large-cap equity funds close to 11.8% annually.

In contrast, traditional “safe” assets such as government bonds (~6.9%) and residential real estate (~5.2%) only marginally kept pace with inflation. The lesson is clear: to truly grow wealth, part of your money must be invested in assets that consistently beat inflation.

(Data based on historical averages from 2015–2025, compiled from public sources such as Economic Times and Times of India. Past performance does not guarantee future returns.)

“Inflation and return figures are based on historical averages (2015–2025) and may vary; past performance is not a guarantee of future results.”

Where to Invest Money in India in 2026

Now comes the real question every teacher and family is asking: where to invest money in India so that it truly grows and beats inflation? Let’s break down the best inflation-beating, wealth-creating options available today.

Before chasing high returns, every teacher or family should build a foundation of safety. India’s government-backed schemes protect your principal and still offer returns slightly above inflation. They won’t make you rich overnight, but they ensure stability.

- PPF – 7.1% tax-free, 15-year lock-in; great for retirement.

- EPF/GPF – ~8% (EPF 8.15% for FY2023–24); safe and steady for salaried teachers.

- NSC – 7.7% with 5-year lock-in, plus 80C tax benefits.

- SSY – 8.2% (for girl child), tax-free and sovereign guaranteed.

- SCSS – 8.2% quarterly payouts, perfect for retired teachers.

- RBI Floating Rate Bonds – ~8.05%, 7-year tenure, zero credit risk.

- Other options – Post Office deposits, KVP (~7.5%), and bank FDs (~6–7%).

These schemes are excellent for capital protection and modest real growth. But to truly create wealth, you’ll need to combine them with higher-return assets like mutual funds, REITs, gold, or NPS.

For a full breakdown of rates, lock-in, tax treatment, and safety features, check my detailed guide here:

Safe Investments in India with High Returns – 2026

Equity Mutual Funds (SIP) – Harness Stock Market Growth

“Returns shown (2015–2025) are based on historical averages; future performance may differ. This is for educational purposes only and not investment advice.”

If beating inflation is the goal, equities have been the most reliable long-term winners. Historically, the stock market has delivered returns well above inflation, making equity mutual funds one of the most practical answers to where to invest money in India for teachers and families who want growth without the stress of picking individual stocks.

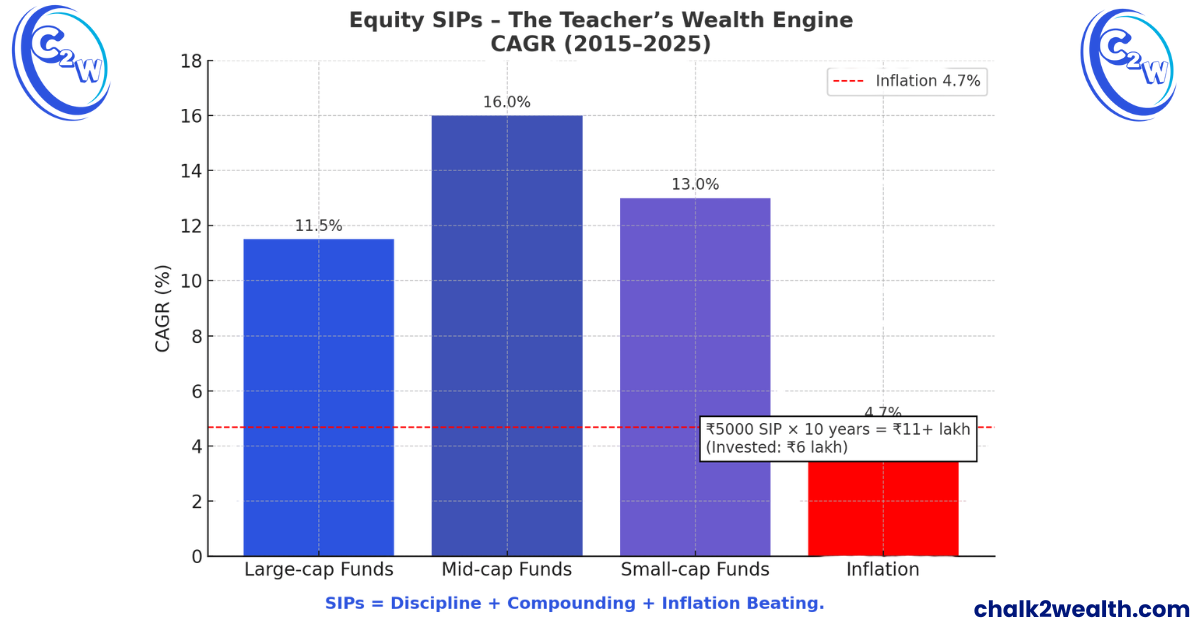

Over the last decade, Indian equity mutual funds delivered strong double-digit returns. Large-cap funds earned about 11–12% CAGR, mid-cap funds around 16%, and small-cap funds close to 13%, while inflation averaged just ~4.7%. This means equities comfortably beat inflation, often tripling or even quadrupling real wealth over 10 years. Even with short-term ups and downs, most equity funds have maintained 5- and 10-year returns above 10%, which is why they consistently feature in discussions on where to invest money in India to beat rising prices.

For beginners, Systematic Investment Plans (SIPs) are the easiest way to invest. By investing a fixed amount every month, SIPs build discipline and reduce market timing risk through rupee-cost averaging. Many teachers unknowingly prioritise loans and purchases over investing—this is why understanding where to invest money in India throughSIPs instead of EMIs can be life-changing, as explained in EMI vs SIP — A Lesson from a Fellow Teacher’s Story.

For example, a ₹5,000 monthly SIP in a Nifty 50 index fund over 10 years would have grown to roughly ₹11+ lakh, on a total investment of ₹6 lakh — a clear demonstration of 12–15% compounding at work. This makes SIPs especially suitable for teachers investing from a monthly salary.

Equity funds are not guaranteed and can fall during market downturns. However, history shows that staying invested for 10 years or more smooths out short-term volatility, as markets broadly track India’s long-term economic growth. Even a modest equity allocation can significantly improve portfolio outcomes for long-term goals—an important insight for anyone evaluating where to invest money in India for the future.

Choosing the right funds matters. Conservative investors don’t need complex strategies. Index funds or diversified large-cap funds are excellent starting points, while those comfortable with volatility may gradually add mid-cap or flexi-cap funds. The key is aligning investments with risk comfort, not chasing returns. Many hesitation points come from outdated beliefs—some of which are addressed in 5 Money Myths That Keep Teachers Broke — And the Truths That Build Financial Freedom.

Teacher’s tip: Don’t fall for the myth that “mutual funds are too risky.” While equity funds fluctuate in the short term, avoiding equities altogether can be riskier for long-term goals because savings may fail to beat inflation. Conservative hybrid funds can reduce volatility, but well-chosen equity mutual funds remain one of the strongest long-term answers to where to invest money in India to build real wealth.

Balanced/Hybrid Funds – Mix of Safety and Growth

“Figures are illustrative based on assumed CAGR (2018–2025); actual returns may differ. This chart is for educational purposes only and not investment advice.”

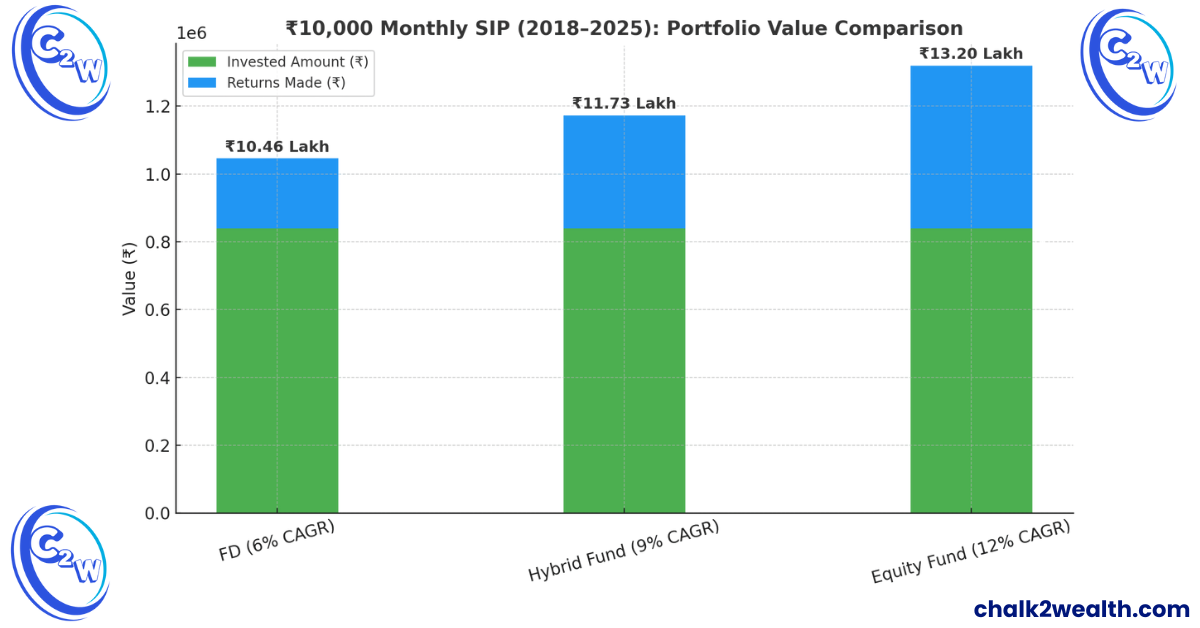

For those who find pure equity funds too volatile, balanced or hybrid mutual funds offer a sensible middle path when deciding where to invest money in India. These funds combine equity for growth and debt for stability in one portfolio. Typically, balanced hybrid funds invest 50–70% in equities, aggressive hybrids around 75%, while conservative hybrids hold just 10–25% in equities, with the rest in safer debt.

Over a full market cycle, good hybrid funds have delivered ~8–10% annual returns—lower than pure equity funds in bull markets, but far better than fixed deposits and with much lower volatility. Many Indian hybrid funds have generated ~9–10% CAGR over the past decade, comfortably beating inflation. For teachers evaluating where to invest money in India without taking excessive risk, hybrids often strike the right balance.

Their strength is most visible during market downturns. If equities fall 10%, a hybrid fund may decline only ~5% due to debt cushioning. When markets rise, the equity portion still participates. This makes SIPs in hybrid funds ideal for teachers who want growth but fear volatility—especially those still choosing between spending and investing, a dilemma explained well in EMI vs SIP — A Lesson from a Fellow Teacher’s Story.

Who should consider hybrid funds?

- Teachers and professionals nervous about stocks

- Mid-career savers wanting better returns than FDs

- Investors nearing retirement seeking safety with growth

- Young investors using hybrids as a stepping stone to equity

A newer variant, Balanced Advantage Funds (BAF), dynamically adjust equity exposure based on market conditions and typically target ~8–10% returns while controlling volatility.

Real teacher example:

Mr. Rajan, a 45-year-old teacher from Himachal, started a ₹5,000 SIP in a hybrid fund in 2018. During the 2020 crash, his investment fell far less than pure equity funds. By 2025, it delivered ~10% annualised returns, clearly outperforming fixed deposits and giving him confidence to gradually increase equity exposure.

Lesson: Hybrid funds help teachers answer where to invest money in India by offering inflation-beating growth with stability—without sleepless nights.

Real Estate & REITs – A Modern Way to Own Property Without Crores

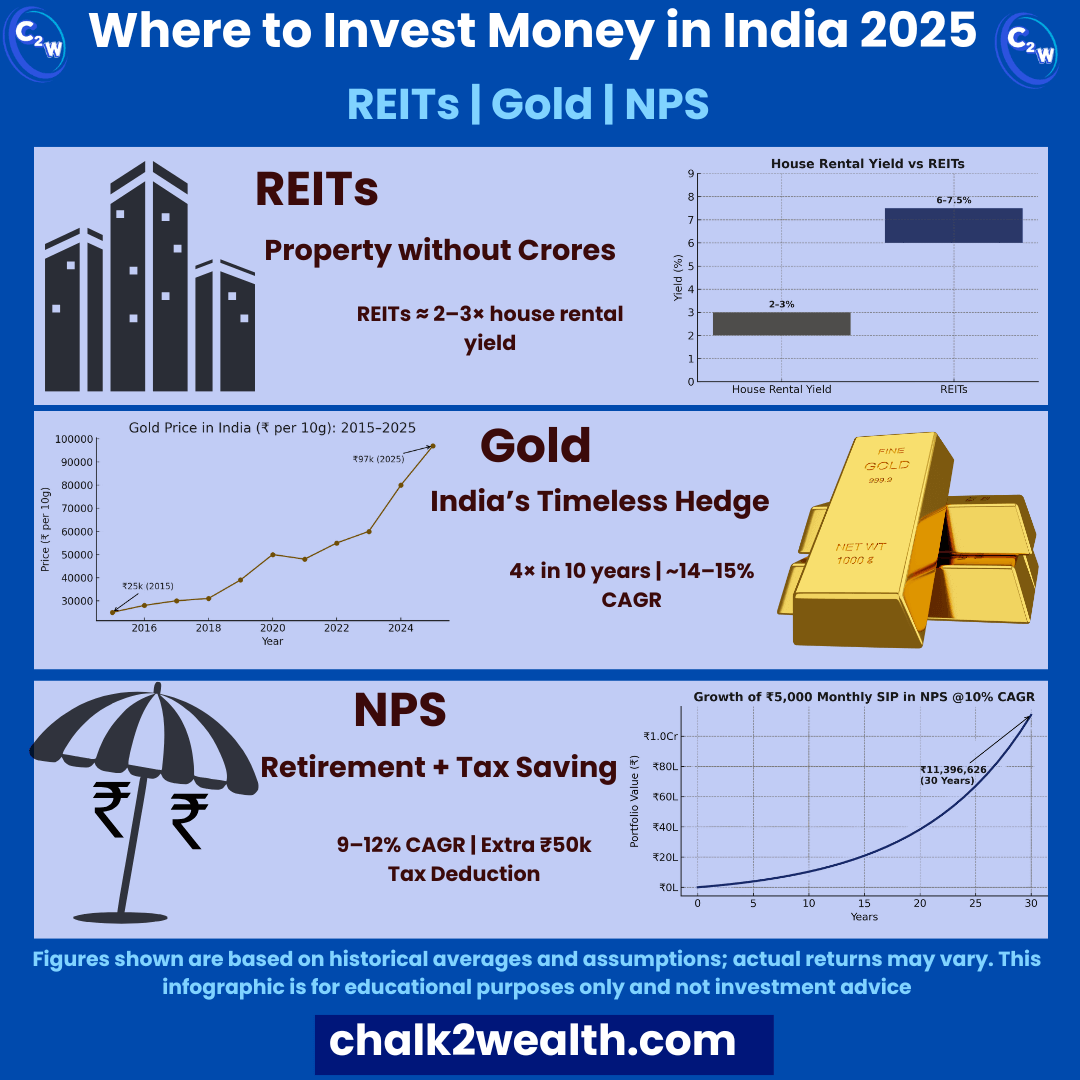

Real estate has long been viewed as a hedge against inflation, as rents and property values tend to rise over time. However, for most teachers and middle-class families, buying physical property means huge capital, heavy loans, poor liquidity, and ongoing maintenance. That’s why, when thinking about where to invest money in India for real estate exposure without ownership stress, many investors now turn to REITs (Real Estate Investment Trusts).

A REIT works much like a mutual fund for property. It owns income-generating assets such as office parks, malls, and commercial complexes, and distributes most of the rental income to investors as dividends. Instead of buying a flat, you can buy REIT units on the stock exchange, just like shares.

Why consider REITs?

- Regular income + growth: Indian REITs currently offer rental yields of ~6%–7.5%, far higher than typical house rental yields (2–3%) and many fixed-income options.

- Inflation protection: As rents and property values rise, REIT payouts and prices tend to grow, helping investors stay ahead of inflation.

- Accessibility: You can start with around ₹10,000, making REITs one of the most practical answers to where to invest money in India for property exposure.

For example, Embassy Office Parks REIT, India’s first REIT (listed in 2019), delivered ~25% total returns in its early years. Even today, its dividend yield remains in the high single digits. Owning a slice of Grade-A office parks in Bengaluru with tenants like Google and JP Morgan—that’s the power of REITs.

Risks & reality check:

REIT prices are market-linked and can react to interest rates or sentiment. They are less volatile than equities, but not risk-free. Their strength often shows during inflationary periods, when rising rents help protect returns.

Who should consider REITs?

- Teachers and professionals who want real estate exposure without crores

- Investors seeking semi-passive, rent-like income

- Anyone looking to diversify beyond stocks and bonds

Many investors prefer building REIT exposure gradually rather than investing a lump sum. If you’re new to this approach, this guide explains what are Systematic Investment Plans (SIPs) and how they work to build wealth in simple terms.

For most teachers, allocating 5–10% of the portfolio to REITs can add smart diversification. It’s like earning rental income without tenants, repairs, or legal hassles. As part of a balanced strategy, REITs are emerging as a practical, inflation-beating option when deciding where to invest money in India.

Gold – Inflation’s Old Foe, India’s Trusted Friend

Gold holds a special place in Indian households—not just culturally, but as a reliable long-term store of value. During periods of inflation, economic stress, or currency weakness, gold often performs well. That’s why, when families think about where to invest money in India to protect wealth during uncertain times, gold remains a trusted choice.

Historical performance tells the story.

Over the last decade, gold prices in India rose from about ₹25,000 per 10g in 2015 to nearly ₹97,000 per 10g in 2025—a near 4× increase, translating to ~14–15% CAGR, well above inflation.

- 2019: ~25% surge

- 2020: ~28% gain during the pandemic

- 2021: Brief ~4% dip, followed by recovery

Despite short-term pauses, gold has consistently created wealth during crisis periods.

Why gold matters in a teacher’s portfolio:

- Low correlation with stocks: Often rises when equities fall

- Inflation hedge: Protects purchasing power as the rupee weakens

- Crisis protector: Shielded wealth during 2020 and the 2022 inflation spike

Most financial planners recommend allocating 5–15% of a portfolio to gold. For teachers and middle-class families evaluating where to invest money in India, gold acts like insurance—adding stability without chasing high risk.

Things to keep in mind:

Gold doesn’t generate regular income (except Sovereign Gold Bonds, which pay 2.5% annual interest) and may stagnate during strong bull markets. But its real strength shows when uncertainty rises.

The numbers speak clearly: ₹1 lakh invested in gold a decade ago is worth ₹3–4 lakh today. For Indian teachers and families, gold isn’t just tradition—it’s a practical tool for long-term wealth protection.

(Fun fact: In 1990, gold was ~₹3200 per 10g. Today ~₹97,000. That’s an 30x increase in 35 years, averaging ~9% yearly. It beat inflation and also many stock portfolios in that long span!)

National Pension System (NPS) – Balanced Retirement Fund with Tax Benefits

The National Pension System (NPS) is a government-backed retirement investment designed to build a long-term pension corpus. From an investment perspective, NPS works like a low-cost diversified mutual fund, investing across equity, corporate bonds, and government bonds. For teachers planning decades ahead and evaluating where to invest money in India for retirement, NPS offers a rare mix of growth, safety, and discipline.

Return profile:

NPS returns are market-linked, but its track record is strong. Over the long term, NPS has delivered ~9–12% CAGR, comfortably beating inflation and outperforming traditional options like PPF (7.1%) and GPF/EPF (~8%). Data from PFRDA shows that NPS equity plans have generated ~10–14% annualised returns over 10 years, while even its government bond component delivered around 9%. This explains why many teachers see NPS as “PF-like safety with mutual fund–like returns.” A deeper reality check is discussed in National Pension Scheme Exposed: Are You Really Saving Enough for Retirement?.

NPS allows flexibility through Active choice (up to 75% equity if you’re under 50) or Auto choice, which gradually reduces risk as you age. This makes NPS a largely hands-off, long-term investment, ideal for retirement goals spanning 25–30 years.

Tax benefits are a major advantage.

NPS offers an exclusive ₹50,000 deduction under Section 80CCD(1B), over and above the ₹1.5 lakh 80C limit. For a teacher in the 20% tax bracket, this means an immediate ₹10,000 tax saving, making NPS one of the most tax-efficient answers to where to invest money in India for retirement. At maturity, 60% of the corpus is tax-free, while 40% is used to buy an annuity.

Lock-in & discipline:

NPS Tier I is locked till age 60 (with limited partial withdrawals), which enforces long-term discipline. Tier II offers liquidity but no tax benefits. Think of NPS as a “don’t-touch-till-retirement” bucket that later converts into monthly pension income.

For young teachers, starting early can be transformative. Even a ₹3,000 monthly contribution, compounded at ~10% over 30 years, can grow into a large retirement corpus, helping beat decades of inflation. Compared with traditional retirement choices, the difference between PPF and NPS becomes critical—explained clearly in PPF vs NPS: Which Is Better for Long-Term Retirement Savings for Teachers?.

One trade-off:

At retirement, 40% of NPS must go into an annuity, which currently offers ~6% returns. Even so, the overall outcome remains far superior to relying only on GPF/EPF or PPF.

Bottom line:

NPS is retirement investing on autopilot—low cost, diversified, tax-efficient, and inflation-beating over the long run. For teachers already contributing to EPF/GPF, NPS works best as a powerful supplement, especially to utilise the extra ₹50,000 tax deduction. If long-term security is the goal, NPS deserves a solid place in your plan.

Other Noteworthy Options

We’ve covered the major asset classes, but whenever the question of where to invest money in India arises, a few other options and doubts often surface.

1. Direct Stocks

Some experienced investors—perhaps that commerce teacher in your staffroom—prefer buying individual stocks. A well-chosen stock like Infosys or Asian Paints has certainly beaten inflation over the long term.

However, direct stock investing demands time, research, and emotional discipline. For most teachers and families, diversified mutual funds or ETFs offer a simpler and safer route to equity exposure. If you genuinely enjoy research and understand businesses, allocating a small portion to direct stocks is fine. Otherwise, let index funds or professional fund managers do the heavy lifting.

2. ULIPs and Traditional Insurance Plans

These are often marketed as “safe investments,” but mixing insurance with investment usually disappoints.

- Endowment plans typically return only ~5–6%, barely matching inflation, with poor liquidity.

- ULIPs invest in markets, but high initial charges often reduce returns compared to mutual funds.

For wealth creation, a better approach is:

- Buy pure term insurance for protection.

- Invest separately in mutual funds, PPF, or REITs.

Golden rule: Insurance is protection, not investment. Let real investments do the compounding.

3. Cryptocurrency and New-Age Assets

By 2025, questions about crypto and NFTs are common, especially from younger teachers and students. The reality is that cryptocurrencies are highly volatile and speculative, with no intrinsic backing. Some gained big—but many lost heavily.

For most teachers and families, crypto is not necessary to beat inflation. At best, it’s a speculative experiment with money you can afford to lose—not a core investment.

Final Thoughts

For most Indian teachers and middle-class families, safety of money has always come first—and rightly so. But as we move through 2026 and beyond, strategies must evolve. The good news is that you don’t have to choose between safety and growth. With informed decisions, it’s possible to build a portfolio that protects capital while steadily growing it. Today, investors have far more options than earlier generations. Government-backed schemes offer 7–8%+ stability, while market-linked instruments like mutual funds, REITs, and NPS have demonstrated the ability to deliver 10%+ returns over the long run. A thoughtful mix of both can help savings not only stay safe, but also beat inflation and build real wealth.

When Dhruv once asked me, “Where to invest money in India?”, I realised the answer isn’t a single product—it’s a recipe. A strong foundation of safe investments, combined with carefully chosen growth assets. Simply saving the traditional way is no longer enough. Inflation is like a silent termite, slowly hollowing out even the strongest-looking savings unless money grows faster than prices.

The encouraging truth is that safe investments with decent returns do exist, and higher-return options can be made safer through knowledge and proper planning. The real hurdle is overcoming old fears and habits. Once that happens, “safe” no longer means settling for low growth. Even a cautious teacher can realistically aim for 8–10% returns and achieve long-term goals without taking unnecessary risks. So here’s to smart investing—chalking out the path to financial security one informed step at a time. As Chalk2Wealth believes:

“Safety does not mean sacrificing growth. A teacher’s best investment is one that protects hard-earned savings and beats inflation.”

FAQs on Where to Invest Money in India

Q1: Which investment is best for high returns?

For long-term high returns, equity mutual funds via SIPs are best.

- Large-cap funds: 11–12% CAGR (stable).

- Mid-cap funds: 14–16% CAGR (higher but riskier).

Teacher takeaway: FD/PPF protect capital, but SIPs grow wealth faster and beat inflation.

Q2: Which investment is best for high returns in India (2026)?

Top options in 2025:

- Equity mutual funds (SIP) → 12–16% CAGR.

- Gold (SGBs) → 14% CAGR in last decade + 2.5% interest.

- REITs → 6–7% yield + growth.

- NPS equity plan → 10–12% CAGR + tax savings.

Teacher takeaway: Combine equity + gold + NPS for high returns and inflation protection.

Q3: Which investment gives the highest return in India 2026?

Historically, the highest returns come from equity-related investments:

- Mid-cap equity mutual funds: ~14–16% CAGR (10 years).

- Small-cap funds: ~13–15% CAGR (high risk, high reward).

- Direct stocks (like Infosys, Asian Paints, HDFC): 15–20%+ CAGR for long-term holders.

- Gold also delivered ~14% CAGR (2015–2025), especially in uncertain times.

- Crypto & new-age assets gave extreme highs but are too risky for most teachers.

Teacher Takeaway:

For long-term wealth creation, equity mutual funds via SIPs are the most practical highest-return option for middle-class families — safer than direct stock picking, and historically beating inflation by 2–3x.

About the Author:

Jagan Charak is the Headmaster of a government school in Himachal Pradesh and the founder of Chalk2Wealth, a teacher-first financial literacy platform. He writes to help teachers and families understand money, avoid common traps like EMIs, credit card debt, and mis-sold insurance, and build long-term financial security. Being an educator himself, he firmly believes that financial education is as critical as academic education for a secure future.

This content is written for educational and informational purposes only. It is not financial advice. Please consult a qualified financial advisor before making investment decisions.

If this article helped you, share it with one fellow teacher today. Together, we can build financial literacy in our staffrooms. And before you leave—drop a comment below: which investment option do you trust the most in 2025? Your experience can guide other teachers too