Consider the story of Narender Kumar, a government school lecturer and close friend of mine. Over 15 years, he diligently contributed to his GPF and built an impressive ₹60 lakh corpus. By retirement, that could easily have crossed ₹1 crore. On paper, it looked like financial success. Yet, when his father needed emergency surgery, he struggled — no health insurance, no SIPs, no quick liquidity. That’s when it hit him: GPF alone isn’t enough.

To achieve real financial freedom, teachers must move toward top investment options that balance safety, liquidity, and higher returns.

Start your journey with:

What Are Systematic Investment Plans (SIPs) and How They Work to Build Wealth

Best SIP Plans: 5 Powerful Options for Wealth Growth in 2025

Best Safe Investment Options in India 2025

Each of these guides dives deeper into the top investment options every Indian teacher should consider — from SIPs and mutual funds to bonds and gold.

For years, teachers across the country have trusted the General Provident Fund (GPF) as their main source of retirement savings. It offers guaranteed returns, tax benefits, and that comforting sense of security every government employee values.

But one afternoon during lunch break, Mrs. Sangeeta, a senior teacher and close colleague, looked up from her tiffin and asked,

“Sir, every month my GPF deduction goes smoothly… but why does it never seem to grow?”

Her question struck a chord — because it’s one so many teachers silently carry. We save diligently through GPF, believing it’s enough to take care of our future. But over time, inflation quietly eats into those fixed returns, and the money that once felt “secure” starts falling short of real-life goals — a peaceful retirement, children’s education, or health emergencies.The truth is, GPF is a safe beginning, not the full story. To truly build wealth and financial freedom, teachers need to explore top investment options that combine safety, growth, and flexibility. These options can help your money work smarter — not just sit idle.

So, teachers, if you’ve been relying solely on your GPF, it’s time to broaden your financial horizons. In this guide, we’ll explore the top investment options beyond GPF — strategies designed especially for educators who want to secure their family’s future and grow their wealth confidently.

For education only, not financial advice. Consult a SEBI advisor before investing.

Table of Contents

ToggleTop Investment Options: 7 Strategies for Teachers Beyond GPF

Top Investment Options Beyond GPF: A Safe Start, But Not a Complete Solution.

While GPF is a trusted savings tool, it comes with key limitations: slow growth (~7.1% returns that barely beat inflation), poor liquidity, no monthly income after retirement, and no protection against health or life risks. If you rely only on GPF, your financial plan lacks balance. It’s time to explore top investment options that combine safety, liquidity, and long-term growth.

Here are seven smart top investment options for teachers—beyond GPF—designed for Indian educators and families who want to build real, lasting wealth. Let’s dive into these top investment options that can truly secure your financial freedom.

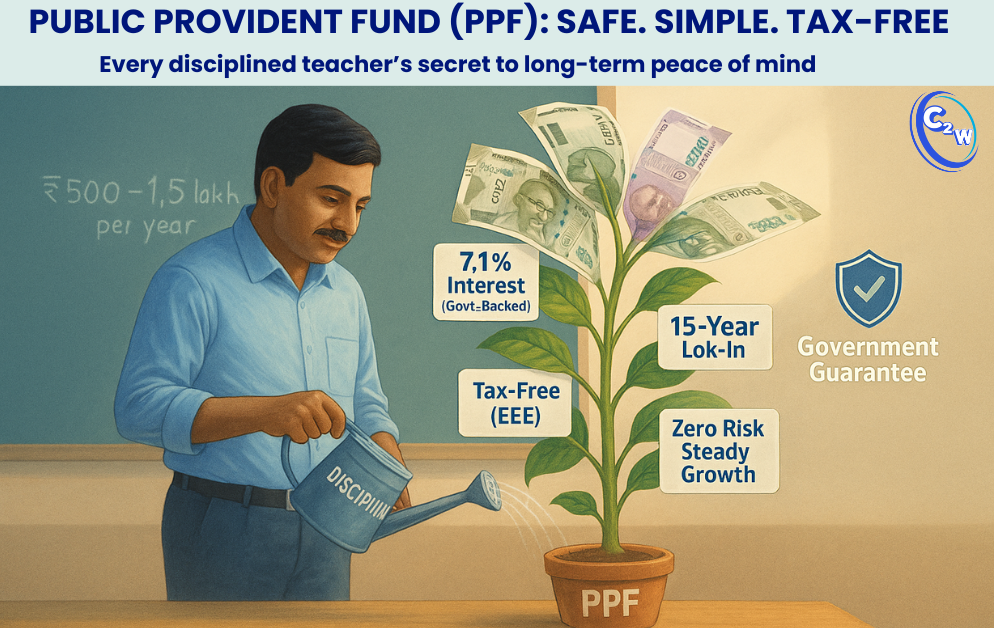

1. Public Provident Fund (PPF) – Safe and Tax-Free Growth

The Public Provident Fund is a long-term, government-backed savings scheme open to everyone. It’s especially popular among teachers for its safety and tax perks. PPF currently offers 7.1% annual interest (compounded yearly), and this rate is reviewed by the government each quarter. The tenure is 15 years, extendable in 5-year blocks, making it truly a long-term investment option.

If you’ve ever wondered how PPF interest is calculated or when and how you can withdraw your PPF amount online, it’s crucial to understand the mechanics. (

Read my full guide — PPF Interest: How to Maximize Your Returns Effectively — to learn how timing your deposits before the 5th of each month can help you earn a full month’s extra interest every year.)

PPF falls under the “Exempt-Exempt-Exempt” (EEE) category – meaning your contributions, the interest earned, and the maturity amount are all tax-free. So, if you’ve been asking, “Is PPF interest taxable?” — the answer is a clear no. You can invest between ₹500 and ₹1.5 lakh per year, and contributions up to ₹1.5 lakh qualify for Section 80C tax deductions. This makes PPF a risk-free, tax-saving vehicle to steadily grow your money. For example, depositing the maximum each year can build a substantial corpus due to the power of compounding and tax-free interest. PPF is ideal for conservative investors planning for retirement or big goals, as it guarantees returns backed by the sovereign. As Exerts notes, it’s “a popular long-term investment option… especially good for teachers who want a safe place to park their money with guaranteed returns”.

Keep in mind: PPF has a 15-year lock-in (with partial withdrawals allowed after 5 years). a feature that answers common questions like “When can I withdraw my PPF?” or “How can I withdraw money from my PPF account?” While this forces discipline, it means you shouldn’t invest money you might need very soon. However, think of PPF as the bedrock of your savings – much like GPF but open to all. It offers stability and a slightly higher interest than inflation, with zero risk. As of the July–Sept 2024 quarter, the PPF rate stands at 7.1% and has remained unchanged, reflecting its consistency. Importantly for teachers, PPF is separate from your GPF/EPF – so it’s a way to contribute beyond your mandatory provident fund towards retirement. In fact, financial experts encourage employees to use instruments like PPF (and Voluntary PF or NPS) to boost retirement savings beyond the employer fund. If you’re a private school teacher without GPF, PPF can play a similar role in your portfolio, offering safe, cumulative growth with full tax exemption on maturity.

To understand the detailed withdrawal process and avoid common mistakes teachers often make, don’t miss this full guide —

PPF Rules for Withdrawal & Common Mistakes: Smart Investing Guide 2026

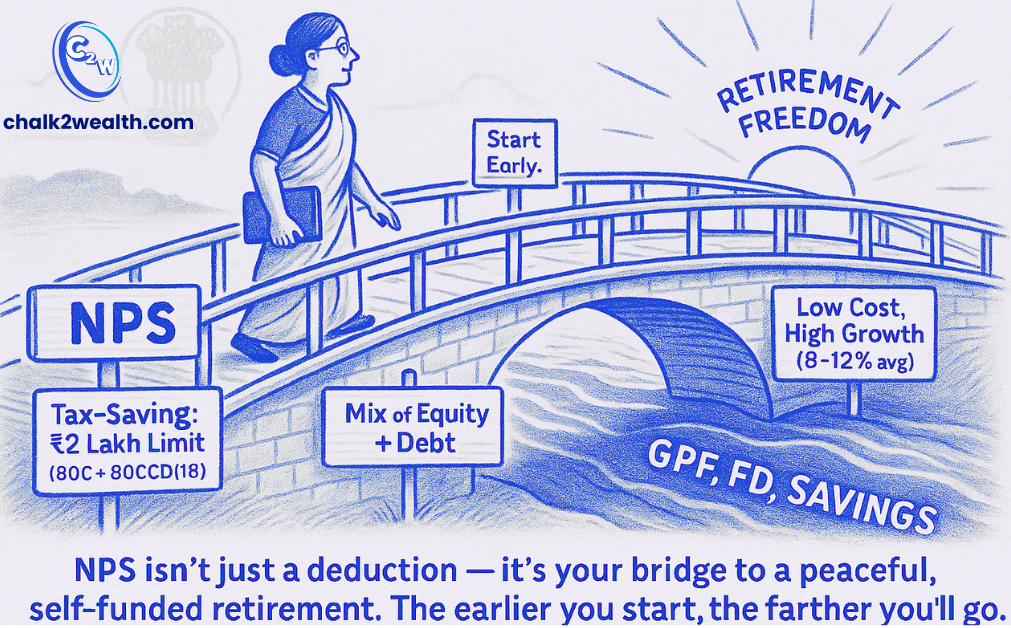

National Pension System (NPS) – Building a Retirement Corpus with Tax Benefits.

The national pension scheme (NPS ) is a government-sponsored retirement investment scheme that mixes equity (stocks) and debt (bonds) for potentially higher returns than fixed deposits or GPF. You contribute regularly during your working years, and at retirement, you can withdraw part of the corpus and use the rest to get a pension. NPS is open to all Indian citizens and has become increasingly popular since its 2009 launch for the public. It is now considered one of the top investment plans for long-term retirement savings in India. (Also read: National Pension Scheme Interest Rates — What Smart Teachers Need to Know to Master Them.)

NPS is specifically designed for long-term wealth accumulation for retirement, and it comes with unique tax benefits. You can claim your NPS contributions as a deduction under Section 80C (within the ₹1.5 lakh limit), and additionally claim ₹50,000 under Section 80CCD(1B) beyond 80C. This extra ₹50k deduction is exclusive to NPS – effectively raising your tax-saving investment limit to ₹2 lakh if you use it fully. For a teacher in the 30% tax bracket, investing ₹50,000 in NPS can save about ₹15,600 in taxes in a year. In other words, the government rewards you for investing in your own pension — making NPS one of the top investment plans for teachers seeking both tax benefits and long-term growth.

To understand whether your NPS contributions are truly on track for retirement, read our detailed breakdown: National Pension Scheme Exposed: Are You Really Saving Enough for Retirement?

Besides tax savings, NPS has ultra-low management fees, which means more of your money stays invested. Over decades, these low charges significantly boost your returns compared to high-cost investments. In fact, the low fees are a key reason NPS funds (both equity and debt) have delivered competitive returns. Economic Times reports that “NPS equity funds have consistently beaten the large-cap mutual fund category in the past 10 years” thanks to lower costs. On average, NPS has yielded about 8–12% annual returns, depending on your asset mix – substantially higher than GPF’s ~7.1% – making it a powerful growth tool for the long run and a core part of India’s top investment plans for retirement. The Pension Fund Regulatory Authority allows you to choose your allocation (up to 75% in equities for younger investors) or opt for an auto-managed life-cycle fund. Over 15–20 years, a well-balanced NPS portfolio can potentially generate a corpus that outpaces traditional provident fund savings.

Keep in mind: NPS is not instantly liquid – it generally locks your money until age 60 (with limited partial withdrawals allowed for specific needs like higher education, marriage, or medical emergencies). Upon retirement, you can withdraw up to 60% of the corpus as a lump sum (which is now 100% tax-free), and at least 40% must be used to purchase an annuity that gives you a monthly pension. While some investors dislike the annuity compulsion, remember that the goal of NPS is to ensure a steady income stream in your golden years (something a one-time GPF lump sum doesn’t provide). The scheme’s flexibility has improved over the years – you can open it online in minutes, choose or change your pension fund manager, and even invest extra through an active Tier-II account (though Tier-II has no tax benefits). Overall, NPS offers everything one looks for in a retirement product: a long-term investment with very low costs and a balanced risk profile. It’s an excellent way for teachers to build a pension beyond the basic government pension or EPF/GPF, and the earlier you start, the greater the compounding benefits. Consider NPS your bridge to a comfortable, self-funded retirement – with the government’s tax incentives as a sweetener for being proactive and one of the top investment plans every teacher should explore.

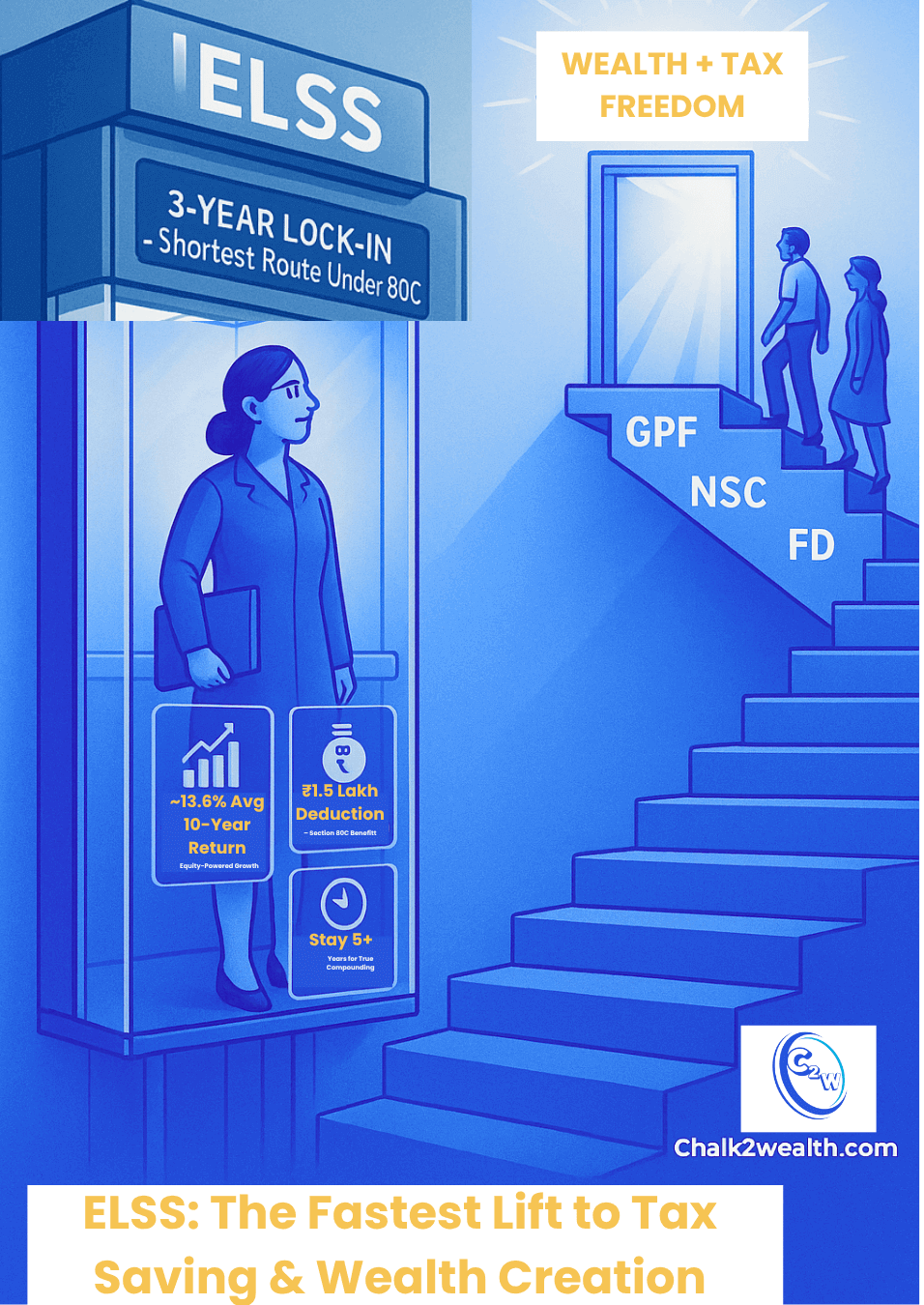

3. Equity-Linked Savings Schemes (ELSS) –One of the Top Investment Options for Tax Saving and Growth

ELSS are diversified equity mutual funds that qualify for tax deduction under Section 80C (up to ₹1.5 lakh per year). In exchange for this tax benefit, ELSS funds come with a 3-year lock-in period, the shortest among all 80C options. Essentially, ELSS funds allow you to invest in the stock market (through a managed fund) while also saving on taxes – a win-win for wealth creation. That’s why many experts list ELSS among the top investment options for individuals seeking both tax efficiency and higher long-term returns.

If you’re looking to grow your money faster than fixed-income instruments, ELSS is an attractive option. These funds invest mostly in stocks, which means returns can fluctuate year to year, but over the long term, they tend to outperform traditional savings. For example, over the 10-year period ending 2025, the ELSS category delivered an average annual return of ~13.6% – far higher than PPF’s 7-8% range. This kind of return can beat inflation by a wide margin, helping you build substantial wealth for goals like children’s education, a home, or early retirement. Moreover, ELSS funds have the shortest lock-in (3 years) among tax-saving investments. By contrast, other 80C options like PPF (15 years) or National Savings Certificate (5 years) tie up your money for longer. The 3-year lock-in not only gives ELSS a liquidity edge, but it also enforces a minimum investing tenure that encourages you to ride out short-term market volatility. For teachers comparing top investment options under Section 80C, this balance of liquidity and growth makes ELSS stand out.

From a tax perspective, ELSS is very efficient. You can invest up to ₹1.5 lakh per year and deduct that from your taxable income under Section 80C. Any gains you withdraw after 3+ years are treated as equity long-term capital gains: currently tax-free up to ₹1 lakh of gains per year, and 10% tax beyond that. For most modest investors, effectively, much of the ELSS gains can be tax-free at redemption, especially if withdrawn gradually. The combination of tax-free contributions and high growth potential makes ELSS a unique tool for double benefits. It’s often recommended as an entry point for first-time equity investors – many teachers start their equity journey with an ELSS fund (via monthly SIPs) and gain comfort with market ups and downs during the lock-in period. As one Economic Times analysis put it: stocks typically offer higher returns over a long period of time – for example, ELSS funds averaged ~13.6% over 10 years – but you should be ready for volatility and invest with a 5+ year horizon for best results. This is another reason ELSS remains one of the top investment options for salaried professionals and educators seeking tax-saving plus growth.

Keep in mind: ELSS funds do carry risk, as their value will rise and fall with the stock market. In a bad market year, you could even see temporary losses (unlike GPF or FDs, which never decline in nominal value). Therefore, patience is key – invest in ELSS with the mindset of at least 5-10 years. The 3-year mandatory lock is just the minimum; it’s wise to stay invested longer to truly enjoy the compounding benefits of equity. Also, not every ELSS fund is the same – some are large-cap oriented, some mid/small-cap heavy. It’s prudent to choose a well-rated, consistently performing fund (there are many rankings available each year). If you’re unsure, start with a balanced or index-based ELSS, which spreads risk. One more tip: instead of a lump sum, invest monthly (SIP) to average out market highs and lows. To sum up, ELSS can be a powerful wealth-builder for teachers: you save taxes today, and potentially reap substantial returns tomorrow, all while diversifying beyond fixed-income. Just remember the golden rule of equity investing: stay invested for the long run. As ET warns, don’t count on great returns in just 3 years – treat ELSS (and any equity) as long-term; historically, Indian equities have compounded at 12–15% annually over the long term, but they reward the patient investor, not the quick trader. No wonder ELSS continues to feature among India’s top investment options for smart, disciplined savers.

Exploring Mutual Funds Beyond ELSS – Discovering More Top Investment Options

While ELSS is one type of mutual fund (with a tax benefit), there’s a whole world of other mutual funds you can invest in that aren’t confined to Section 80C limits. These include index funds, flexi-cap funds, large-cap, mid-cap, or hybrid funds – any fund that suits your risk profile and time horizon. Investing in them via a Systematic Investment Plan (SIP) (small fixed amounts every month) is a popular strategy to build wealth gradually. Think of this as beyond your tax-saving investments – these are for pure growth and achieving big goals. When we talk about top investment options for teachers and salaried professionals, these diversified mutual funds rank high for long-term wealth creation.

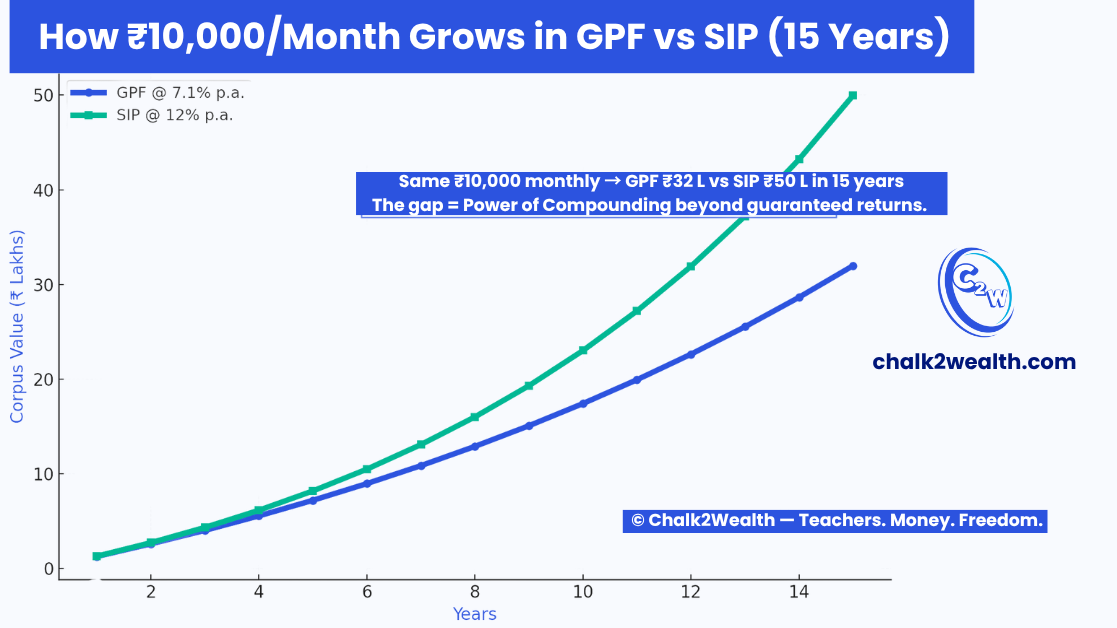

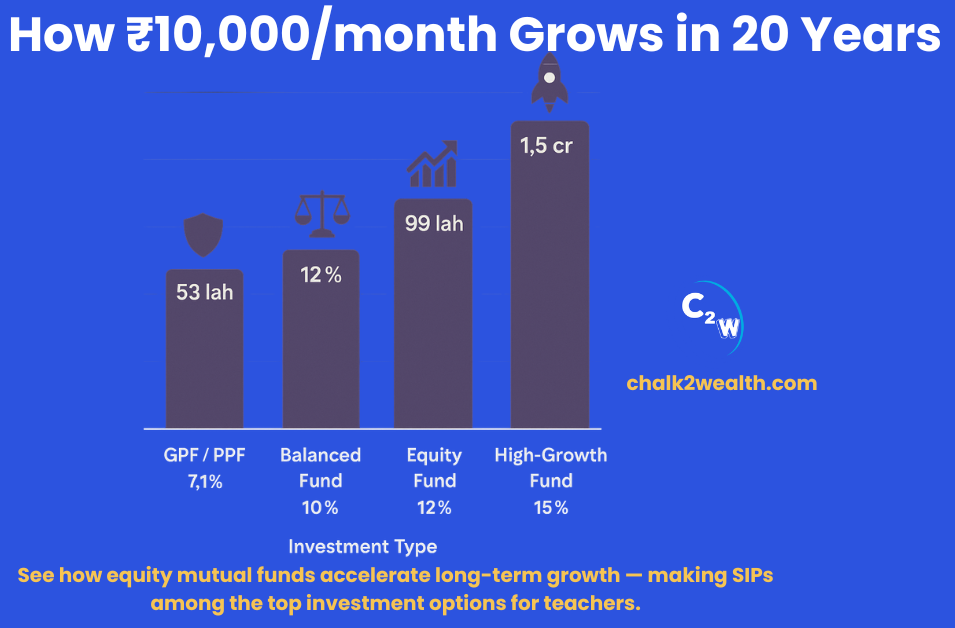

As a teacher, you already understand the power of steady progress – that’s exactly what SIPs in equity funds offer. By investing, say, ₹2,000 or ₹5,000 every month consistently, you harness the power of compounding and rupee-cost averaging. Over time, the stock market’s growth can turn these small contributions into a significant corpus. To illustrate, consider a comparison between safe and equity investments: A ₹10,000 per month investment for 20 years at GPF’s 7.1% would grow to about ₹52.5 lakh. But the same investment in a balanced fund (~10% return) could yield ~₹76 lakh, and in a pure equity fund (~12% return) around ₹98 lakh – almost double the GPF outcome. In fact, if equity markets perform exceptionally (15% CAGR), the corpus could exceed ₹1.5 crore – clearly showing why SIPs in equity mutual funds are counted among top investment options for long-term wealth creation. The earlier you start, the greater the gap becomes, thanks to compounding. This can make a life-changing difference in funding your dreams like a comfortable retirement, children’s higher education, or that house you always wanted.

Importantly, diversified mutual funds spread your risk across dozens of companies and sectors, and are managed by professionals. You don’t have to be a stock-picking expert or track the market daily. For beginners or cautious investors, hybrid funds (balanced funds that mix equity and debt) offer moderate growth with smoother rides. For long-term goals, equity funds (large-cap or index funds, etc.) can provide higher returns with acceptable volatility. Renowned investor Raamdeo Agrawal recently noted that Indian equities can compound at ~12–15% annually over the long term, and even plain index investments alone can generate ~12% if held for 15-20 years. This suggests that by staying invested in equity funds over your career, you can significantly outpace inflation and provident fund returns. That’s why many financial planners recommend mutual fund SIPs as one of the top investment options to build real wealth and financial independence.

How to do it: The key is discipline and consistency. Set up an automatic SIP that aligns with your paycheck, so investing becomes as routine as a PF deduction. You can start with even ₹500/₹1000 per month, so budget is no excuse (many funds have low minimums). Increase the contribution as your salary grows or when you can cut unnecessary expenses. Also, diversify across fund types – e.g., an index fund for core holdings, maybe a balanced fund for stability, or a respected aggressive equity fund for higher growth. Avoid the temptation to stop or withdraw during market dips; those are actually the best times to keep investing (you buy units cheap). History shows that despite interim ups and downs, the longer-term trend of the market is up, mirroring India’s economic growth. Over, say, 10–15 years, you have a good chance of achieving that ~12% CAGR if you remain patient. As one Mint article echoed Pollack’s famous finance rule: “Buy inexpensive, well-diversified mutual funds… and invest at least 20% of your income” for the future. This mindset of regular investing is exactly what makes SIPs among the top investment options in India today.

Bottom line: Mutual fund SIPs are a must-have in a teacher’s investment plan beyond GPF. They provide the growth engine your portfolio needs to beat inflation and achieve long-term goals. Use them to supplement your provident fund and PPF savings. By balancing safe options with equity funds, you get the best of both worlds – stability and high growth. Just remember, like tending to a student’s progress, monitor your funds periodically (say, once a year) but don’t obsess daily. Stick to the process. In the long run, the results can be truly rewarding – perhaps the difference between a modest retirement and a fulfilling one. Your future self will thank you for the farsightedness of starting those SIPs today – one of the smartest top investment options you can ever choose.

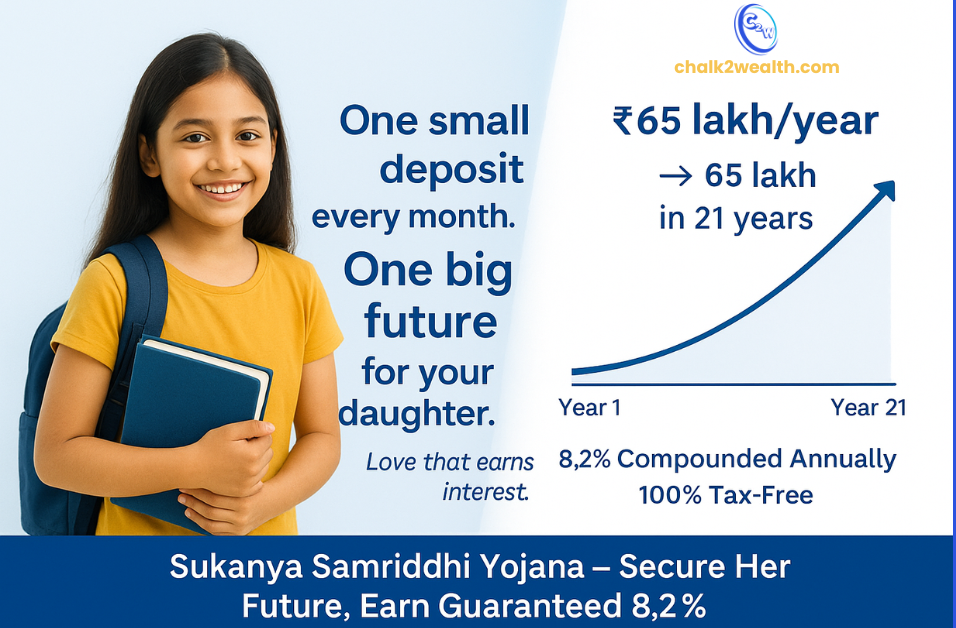

5. Sukanya Samriddhi Yojana (SSY) – Secure Your Daughter’s Future, Earn High Interest

The Sukanya Samriddhi Yojana is a special government savings scheme for the girl child, part of the “Beti Bachao, Beti Padhao” initiative. If you have a daughter (or up to two daughters) under age 10, you can open an SSY account in her name. It offers a fixed high interest rate (currently 8.2% per annum) compounded annually, with tax benefits similar to PPF. The account matures when the girl turns 21, helping provide for her higher education or marriage. Among India’s top investment options for long-term savings, SSY stands out for combining safety, guaranteed returns, and social purpose.

Why teachers (with daughters) should consider SSY: SSY is one of the highest-paying small savings schemes in India right now – at 8.2% interest, it outshines even PPF or NSC rates. And like PPF, it enjoys EEE tax treatment: contributions up to ₹1.5 lakh/year qualify under Section 80C, and the interest and maturity proceeds are completely tax-free. This combination of high, guaranteed return and tax exemption is hard to beat for risk-averse investors. For a teacher planning for their daughter’s future, SSY is a no-brainer choice to accumulate a sizable, safe corpus. For instance, if you invest the maximum ₹1.5 lakh each year for 15 years (the maximum deposit period), at 8.2% interest, the maturity amount when your daughter is 21 can be around ₹65–70 lakh (exact figure depends on rates over the years) Even smaller contributions can grow impressively over two decades thanks to compounding. This makes SSY not just a savings plan, but one of the top investment options for securing your child’s education and future.

Key features: You can start with as little as ₹250 to open the account, so it’s accessible to all. Each year, a minimum of ₹250 (and up to ₹1.5 lakh) must be deposited to keep the account active. The scheme has a 21-year term from opening, but you only contribute for 15 years – after that, it earns interest without further deposits until maturity at 21 years. Notably, partial withdrawals (up to 50% of the balance) are allowed once the girl turns 18 for her educational expenses. This means when your daughter is ready for college, you can withdraw some funds to pay tuition, while the rest continues to earn interest. The account fully matures at 21 years of the girl’s age, giving her the final amount for use as needed (perhaps for higher studies or marriage). SSY’s structure and guaranteed returns make it one of the top investment options under government schemes for those prioritizing safety over market risk.

Keep in mind: SSY is meant solely for those with a girl child – it’s a targeted scheme. It locks in money for a long period, so ensure you won’t need these funds for other purposes. The interest rate, while currently high, is not fixed for the entire duration; the government can revise it quarterly. That said, it has remained at 8.0–8.5% in recent times, and being a flagship scheme, it tends to offer a premium over other small savings rates (for instance, it stayed at 8.2% through multiple quarters of 2024–25 when PPF was 7.1%).

If you don’t have a daughter, you obviously can’t invest in SSY. – In that case, consider a Public Provident Fund or a child-oriented mutual fund for your child’s future. But for those who are eligible, SSY is arguably among the top investment options available today for guaranteed, tax-free, long-term growth. It instills a habit of saving for your girl child and rewards you generously for it. Many teachers appreciate the social angle too – you’re not only saving money, but also affirming the importance of your daughter’s financial security.

In summary, SSY offers assured, high returns with full tax exemption and a focus on your child’s welfare. It’s a shining example of an investment that is both financially and emotionally rewarding – truly one of the top investment options every eligible parent should consider.

6. Gold and Sovereign Gold Bonds – Diversification with a Traditional Asset

Gold has always held a special place in Indian households – not just as jewelry or tradition, but also as a store of value. As an investment, gold tends to protect your wealth during economic uncertainties and inflation. While you can buy physical gold (coins, bars, etc.), modern options like Gold ETFs, Gold mutual funds, or Sovereign Gold Bonds (SGBs) are more convenient and cost-effective. SGBs, issued by the Government of India, deserve a special mention: they pay a fixed 2.5% yearly interest on your investment in addition to the price appreciation of gold, and on maturity (8 years) any capital gain is tax-free. Among India’s top investment options for stability and diversification, SGBs stand out as a smart, government-backed choice.

The primary reason is diversification and safety. Gold often has an inverse or low correlation with equities – when stock markets are down or inflation is high, gold prices usually rise, providing balance to your portfolio. Over the long term, gold in India has delivered moderate growth. Historical data shows gold has given around 8–10% annual returns in rupee terms over the past decade . For instance, between 2014 and 2024, gold prices roughly doubled from ~₹26,000 per 10g to ~₹52,000+, averaging high single-digit growth . While that’s lower than equity returns, it has been more stable during crises. During the 2020 pandemic, gold prices spiked to record highs as people sought safe assets

Inflation hedge: Gold is seen as a hedge against cost-of-living increases – when inflation erodes the value of paper money, tangible assets like gold often appreciate. The World Gold Council found that in periods of high inflation, gold delivered strong returns (sometimes even double-digit in real terms). For a long-term investor like a teacher, a small allocation to gold (say 5–10% of your investments) can add a layer of protection. It’s like an insurance within your portfolio against economic turmoil. That’s why gold continues to feature among top investment options for conservative investors seeking balance and inflation protection. While buying gold jewelry or coins is common, it comes with issues: making charges, storage safety, no regular income, and possibly impurity concerns. Sovereign Gold Bonds (SGBs), on the other hand, have multiple advantages. You get the market price of gold on maturity plus 2.5% annual interest paid to your bank account. Since SGBs are government-backed, there’s no default risk. And crucially, if you hold them to maturity, any capital gain is completely tax-free (whereas selling physical gold after long-term incurs 20% tax on gains). SGBs have an 8-year term (with an exit option after 5 years), making them fit for medium-to-long-term holding.

Gold ETFs or mutual funds are another route – they allow you to buy gold in small units via your demat account or fund account. They mirror gold prices and can be bought/sold anytime like a stock, providing liquidity and convenience. Also, they don’t require worrying about lockers or theft – everything is electronic. For teachers who may not have experience with demat accounts, gold funds (which don’t need one) are an excellent alternative. These modern instruments make gold not just a traditional holding but one of the top investment options for digital-age investors who value safety with simplicity.

Role in your portfolio: Think of gold as a stability anchor. It won’t give multibagger returns, but it preserves wealth. In years when your equity funds might underperform or when global events cause market panic, gold often shines. By holding some gold, you can potentially sell or rebalance when its value is high and buy other assets cheap, thus improving overall returns. Moreover, gold’s returns, though moderate, have beaten inflation over the long run. A study of gold index funds in India showed 8–12% annual returns in the past 5–10 years, particularly doing well during economic stress periods. Such stability makes gold a vital part of any diversified plan featuring top investment options.

Practical approach: Consider investing in SGBs periodically (the government opens a new tranche every couple of months) or set up a small monthly investment in a Gold ETF/MF just as you would an SIP. This way, you accumulate gold units without timing the market. And when gold prices rally, you’ll be glad you had some in your locker (figuratively speaking). However, avoid over-allocating to gold – it should complement your holdings, not dominate them, because over very long periods, equities and even some bonds may outpace gold in growth. Around 5–10% is typically recommended by experts as a portion for gold in a balanced portfolio.

Bottom line: Gold investment provides security, diversification, and emotional comfort – values teachers and families deeply appreciate. As the saying goes, “Don’t put all your eggs in one basket.” Gold is that other basket that ensures not all your investments are moving in the same direction. For those building a strong, well-diversified portfolio, gold and Sovereign Gold Bonds remain timeless and trustworthy among India’s top investment options.

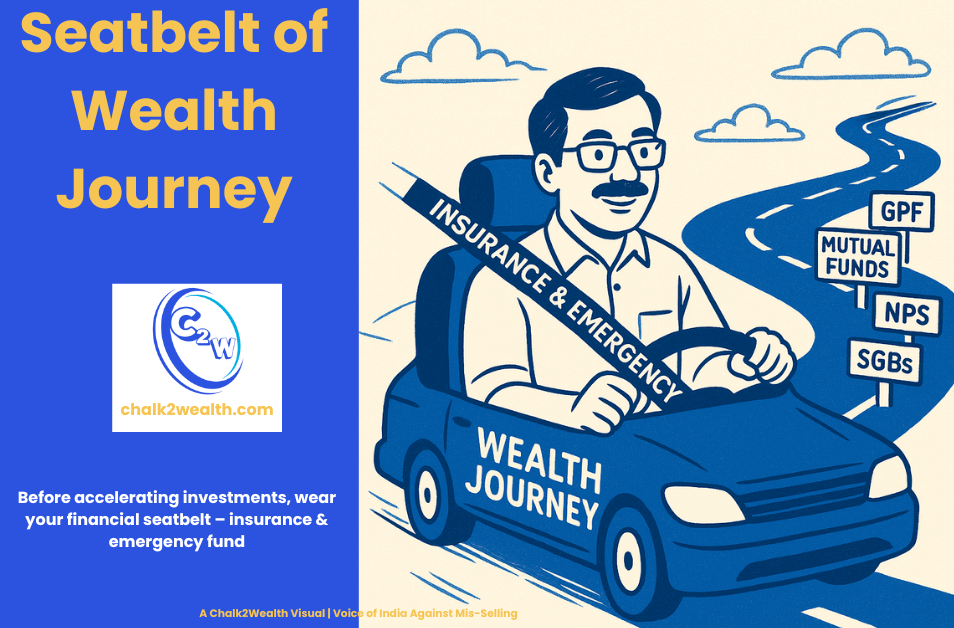

7. Insurance and Emergency Funds – Protect Your Wealth and Family

This final point is less about growing money and more about safeguarding it – but it’s so critical that it deserves to be in your top strategies. There’s little point in building a great investment portfolio if an unforeseen disaster can wipe it out or leave your family in financial jeopardy. Insurance and emergency savings act as the safety nets under your financial plan, ensuring that life’s surprises don’t derail your long-term goals. In fact, no list of top investment options is complete without also addressing how to protect those investments.

Why have an Emergency Fund: An emergency fund is a pool of liquid money (cash or quick-to-withdraw investments) that you set aside strictly for contingencies – medical emergencies, sudden home or car repairs, or temporary loss of income, for example. The general rule of thumb is to save 3–6 months’ worth of expenses in an accessible account. For a teacher, this could mean having a few lakhs in a high-interest savings account or a liquid mutual fund that you can tap into immediately if needed.

The earlier anecdote of the lecturer struggling to arrange funds despite a hefty GPF underscores this – GPF couldn’t be accessed in time. Had he maintained an emergency fund, he wouldn’t have had to scramble or borrow. Liquidity is the key here: GPF, PPF, SSBs, etc., are not liquid; even mutual funds take a couple of days to redeem. So, keep some money in a place you can get it overnight. Many Indian financial planners suggest a sweep-in fixed deposit, a money market fund, or simply a savings account buffer for this purpose.

It may not earn huge interest, but think of it as insurance you pay yourself. In a crisis, you don’t want to be selling your stocks or breaking your PPF (which might not even be possible) – that could also mean losing out on future growth or incurring penalties. An emergency fund ensures your long-term investments – including your top investment options like ELSS, NPS, or SGBs – stay untouched for long-term goals. It gives immense peace of mind, which is priceless. As one guide for educators put it, having that rainy-day fund means “your savings are truly helpful only if they’re available when you need them” . So, if you haven’t already, start putting a bit of each paycheck into a contingency reserve until you hit your 3–6 month target. You’ll sleep better for it.

Why have Insurance (Health and Life): Life insurance (term plan) is a must for any family where others depend on your income – and that includes most teachers with children or non-working spouses. It’s not an “investment” that gives returns, but rather a protection that for a relatively small annual premium, a large sum will go to your family if you’re not around. As blunt as it sounds, think of the financial gap your absence would create.

A pure term insurance plan is recommended because it offers high coverage (running into crores) at low cost, without unnecessary investment components. For example, a 30-something teacher can often get ₹1 crore term cover for maybe ₹8,000–₹12,000 per year (depending on age and health). This ₹1 crore can ensure your family can pay off a home loan, fund the kids’ education, and have an income-generating corpus, so they aren’t forced into hardship.

One financial tip for teachers says, “You are not responsible until you get a term insurance plan. A term plan ensures your family doesn’t have to compromise on their living standard when you are no longer present”. We couldn’t agree more. Don’t rely solely on any employer-provided insurance (government jobs might offer some lump sum or pension to the spouse, but often it’s not enough for all needs). Get your own adequate cover – a rule of thumb is at least 10–15 times your annual income, or more if you have young children and loans. Also, the earlier you buy, the cheaper it is , so don’t delay and let premiums rise with age.

Health insurance is equally vital. Government teachers may have CGHS or state schemes, and private teachers might have group mediclaim from the school – but check the coverage limits. Medical costs are skyrocketing, and a single hospitalization can cost lakhs. A family floater policy of ₹5–10 lakh (or more, if feasible) ensures you don’t dip into savings or take loans for medical bills. Even if you have a public sector health scheme, a private top-up cover can be useful for treatments not fully covered or to use at hospitals of your choice.

Remember, GPF or fixed deposits can’t protect your health – only insurance can. And using insurance for hospital bills preserves your investments to continue compounding. As financial advisors often say, health and life insurance are the foundation of any sound financial plan. They guard “against medical emergencies or life’s unexpected turns – something GPF or investments alone won’t cover” . These protections ensure that your top investment options—like mutual funds, PPF, or NPS—are not derailed by unexpected events.

In summary: Before you aggressively chase returns, secure your base. Build an emergency fund so that an emergency doesn’t force you into debt or to liquidate investments at the wrong time. And get sufficient insurance so that life’s uncertainties (be it an illness, accident, or untimely demise) do not collapse the financial security you’re building.

Think of these as the seatbelt while you drive towards wealth – you hope to never need the protection, but you must have it. With this safety net in place, you can invest in all the exciting opportunities from sections 1–6 with far greater confidence and peace of mind. Because ultimately, even the top investment options mean little without the foundation of security beneath them.

Conclusion: Balancing Safety and Growth for a Prosperous Future

As a teacher, you impart lessons of planning and patience to your students every day – it’s time to apply those principles to your own finances. The key takeaway is that relying on just “safe” options like GPF or bank FDs will likely not be enough to meet all your future needs. Inflation quietly erodes the value of those static savings, and life’s emergencies demand liquidity and protection. By diversifying into a mix of secure instruments (PPF, SSY, bonds) and growth-oriented investments (NPS, mutual funds, ELSS, gold), you create a balanced portfolio that can both protect your capital and grow it. Take advantage of the provisions under Indian law like Section 80C and 80CCD – they’re there to encourage you to save and invest for good reason. A teacher with a thoughtful financial plan might max out the 80C limit (through PF, PPF, ELSS, etc.) to save on taxes, and then invest further via SIPs or other vehicles for additional growth. Each of the 7 strategies above plays a role: some offer guaranteed, tax-free returns; others offer high-growth potential; some provide safety nets and diversification. Together, they make a formidable strategy.

What are the best investment options in India?

The best investment options depend on your goals, risk appetite, and time horizon. For most salaried individuals and teachers, a balanced mix of safe and growth-oriented options works best.

- For Safety & Guaranteed Returns: PPF, Sukanya Samriddhi Yojana, Post Office Schemes, SCSS

- For Long-Term Wealth Creation: Equity Mutual Funds (SIPs), Index Funds, ELSS

- For Retirement Planning: NPS, EPF, GPF

- For Diversification: Gold ETFs, Sovereign Gold Bonds, REITs

- For Protection: Term Insurance and Health Insurance

Tip: Always build your financial foundation in this order — Protect → Save → Grow.

what is the best investment in india

There’s no single “best” investment — the right one depends on your financial goal, time frame, and risk tolerance.

However, for most Indians (especially salaried professionals and teachers), the best results come from a balanced mix of options:

- For Safety: Public Provident Fund (PPF), Sukanya Samriddhi Yojana, Fixed Deposits

- For Growth: Equity Mutual Funds through SIPs, Index Funds, and ELSS (tax-saving funds)

- For Retirement: National Pension System (NPS), EPF/GPF

- For Diversification: Gold ETFs, Sovereign Gold Bonds (SGBs), Real Estate Investment Trusts (REITs)

- For Protection: Term Insurance and Health Insurance — before any investing

Simple Rule: Build your safety net → then invest regularly for long-term wealth.

what is the best option for investment in india

The best investment option in India depends on your financial goals, age, and risk appetite. For most people, a diversified mix works best — combining options like PPF, ELSS, equity mutual funds, and modest insurance policies to balance safety, growth, and protection.

How much to invest every month?

There’s no fixed amount, but a good starting point is to invest at least 10% to 15% of your monthly salary. For example, if you earn ₹50,000 per month, aim to invest ₹10,000 through SIPs in mutual funds, PPF, or ELSS. If you can increase it gradually, you’ll build a stronger corpus.

How much to invest in NPS every month?

How much to invest in NPS depends on your age, income, and retirement goal. A simple rule is to invest 10–15% of your monthly salary in the National Pension System (NPS) if you want to build a strong retirement corpus.

Is NPS a good investment?

Yes, NPS (National Pension System) is a good investment for long-term retirement planning.

It offers market-linked growth, low charges, and tax benefits under Sections 80C and 80CCD(1B) — making it one of the most efficient retirement options in India.

The content shared in this article, “Top Investment Options: 7 Strategies for Teachers Beyond GPF,” is for educational and informational purposes only. It is not financial, tax, or investment advice. Investments in financial markets are subject to risks, and readers should consult a SEBI-registered financial advisor before making any investment decisions.