Table of Contents

ToggleBest SIP Plans: 5 Powerful Options for Wealth Growth in 2025

By Jagan Charak — School Leader ,Lifelong Learner, and Financial Storyteller

I remember life back in 2009 as a ₹15,000/month school teacher with no savings plan. Bills, kids’ tuition and emergencies would gobble up my entire salary – leaving nothing for the future. That’s when I first discovered SIPs (Systematic Investment Plans) in mutual funds. With some courage, I started small – just ₹3,500 per month (about 25% of my income) into flexi-cap and value-oriented mutual funds like Parag Parikh Flexi Cap, SBI Contra and ICICI Prudential Value Discovery. At that time, these were considered among the Best SIP Plans for long-term wealth creation.

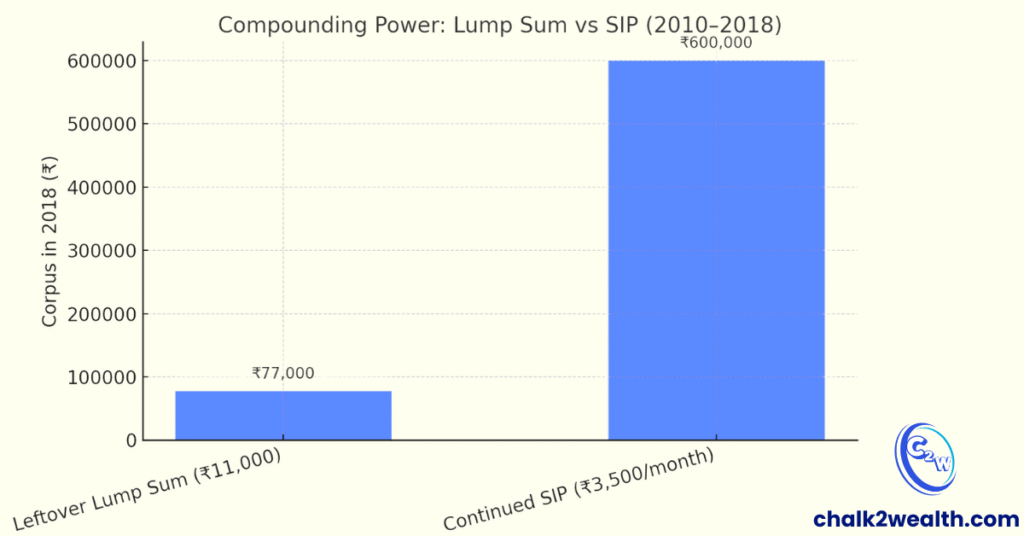

For 11 disciplined months I stayed the course. But when the market crashed in late 2010, fear got the better of me. I panicked and sold almost everything—leaving only ₹11,000 “by accident” in one fund. That accident became my greatest teacher.

By 2018, without investing a single extra rupee, that leftover ₹11,000 had quietly compounded to nearly ₹77,000. Meanwhile, I calculated that if I had simply continued my ₹3,500/month SIPs, my corpus by 2018 would have crossed ₹6 lakh (and many lakhs more by today).

The realisation hit me: time and compounding are stronger than fear. The market rewards discipline, not panic.

For today’s teachers and families starting their journey, the Best SIP Plans aren’t just about which fund you pick—it’s about staying invested through ups and downs, letting compounding quietly do its magic.

Best SIP Plans for Teachers to Start Small and Grow Big

These days I tell my teacher friends: Yes, even a ₹15K salary is enough to invest. Starting even a small SIP (₹500–1,000 per month) immediately can compound into serious wealth over 10–15 years.

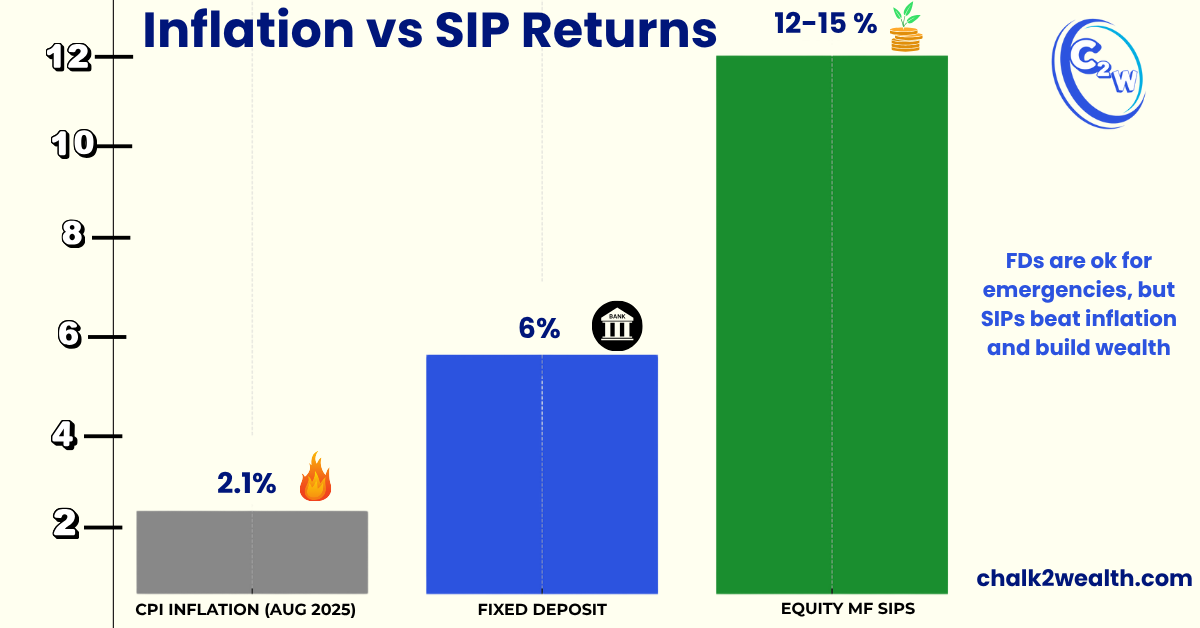

Consider the facts: according to DD News India’s inflation is very low (CPI around 2.1% in Aug 2025 ), while equity mutual funds have historically delivered much higher returns. No fixed deposit can match that growth.

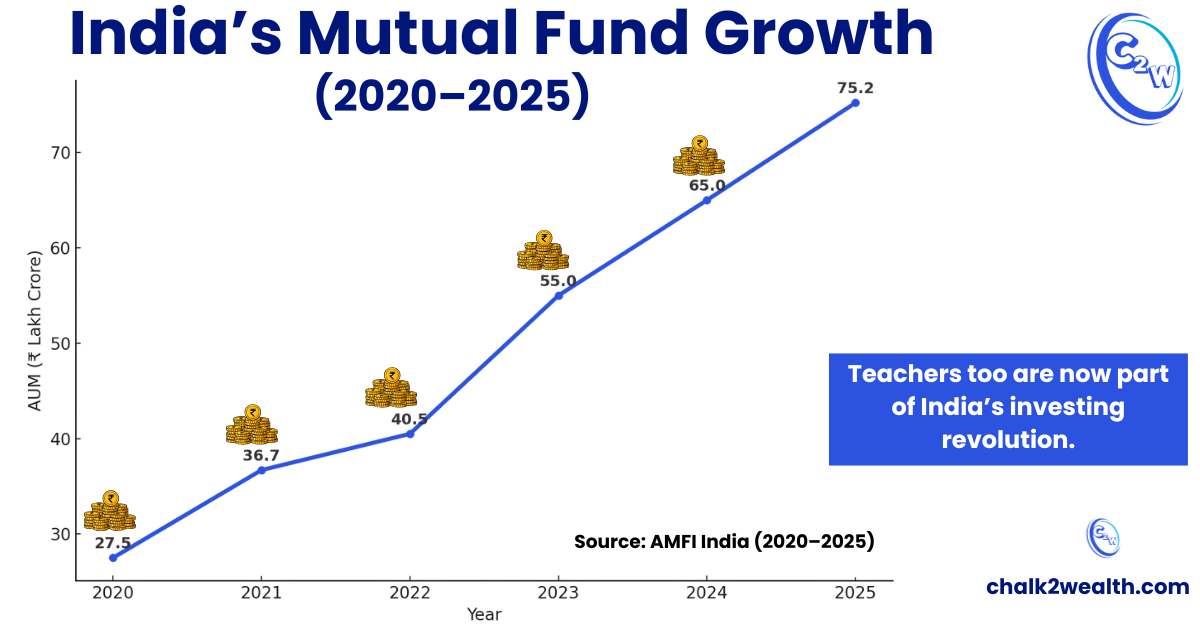

In fact, India’s mutual fund AUM has exploded in recent years – from ₹27.5 lakh crore in Aug 2020 to ₹75.2 lakh crore by Aug 2025 (sources amfiindia.com)— nearly a three-fold jump in just 5 years. SIPs are mainstream wealth-builders now, especially for salaried professionals like teachers.

The key is to start now and stick with it. Below, based on Value Research, Moneycontrol, AMFI data , are five Best SIP Plans for 2025 — each with 10+ year track records, strong returns, and low expense ratios.

Parag Parikh Flexi Cap Fund (Direct – Growth) – Flexi Cap. A highly diversified equity fund (large/mid/small caps and global stocks) managed by Rajeev Thakkar. It has AUM ~₹1.15 lakh crore and a very low expense ratio (0.63%). Over the past 5 years it returned about 180% total (~22.9% CAGR and Value Research rates it 5 stars) This is a core long-term fund for growth, with proven consistency.

ICICI Prudential Value Fund (Direct – Growth) – Value-Style Equity. A large fund (AUM ~₹53,750 Cr) managed by Sankaran Naren and team. It hunts for undervalued large/mid-cap stocks. Its expense is 0.98%. It delivered about 230% over 5 years (~27.0% CAGR), beating most peers. (VR rating: 5 star) This contrarian/value approach has rewarded patient investors with top returns.

Nippon India Multi Cap Fund (Direct – Growth) – Multi Cap. A broad fund (AUM ~₹46,216 Cr) by Sailesh Bhan & Ashutosh Bhargava, mandating at least 25% each in large, mid and small caps. It has expense 1.51%. Impressively, it delivered roughly 286% in 5 years (~30.0% CAGR) – the highest 5-year absolute gain among these picks. (VR rating: 5 stars) This fund’s aggressive multi-cap strategy paid off handsomely.

Kotak Large & Midcap Fund (Direct – Growth) – Large & Mid Cap Blend. A solid fund (AUM ~₹27,655 Cr) by Harsha Upadhyaya, keeping equity split at least 35% large and 35% mid cap. Its direct expense ratio is just 0.53%. Over 5 years it returned ~186% (~23.6% CAGR). (Value Research rating 3 stars on returns, but it’s a proven core holding.) With lower AUM it has room to grow, and it combines stability (large caps) with high-growth potential (mid caps).

SBI Contra Fund (Direct – Growth) – Contra/Value. A pure contrarian equity fund (AUM ~₹46,654 Cr) managed by Dinesh Balachandran. It invests in quality stocks when they are temporarily beaten down. Its expense is 0.75%. Over the last 5 years it returned ~274% (~30.0% CAGR), ranking among the best in its category. (VR rating: 5 stars) This fund’s value-driven, long-term approach can significantly boost a SIP portfolio when markets recover from dips.

These five funds cover India’s equity space (flexi-cap, value, multi-cap, large+mid, contrarian). All carry “Very High” risk as expected for equity, but their decade-long track records and experienced managers (e.g. Rajeev Thakkar at PPFAS, Sankaran Naren at ICICI Pru, etc.) speak for themselves. Their latest AUM, expense ratios and 5-year returns are drawn from official data -(Value Research, AMFI, Money control)

Best SIP Plans are riding India’s mutual fund boom. In the last five years, the industry’s AUM has grown nearly three-fold — from ₹27.5 lakh crore in August 2020 to ₹75.2 lakh crore in August 2025 (Source: AMFI India).

This growth proves that SIPs are now a mainstream wealth-building tool, not just for big investors but also for teachers, salaried professionals, and middle-class families.

Teacher Insight: Even a small SIP of ₹500–1,000 per month allows teachers to beat inflation, stay disciplined, and become part of India’s investing revolution.

This chart is for educational purposes only. Past performance of mutual funds does not guarantee future results. All mutual fund investments are subject to market risks. Please read all scheme-related documents carefully or consult a SEBI-registered financial advisor before investing

Best SIP Plans Recap

| Fund (Direct – Growth) | Category | 5Y Return (approx) | AUM (₹ Cr) | Expense | Manager |

|---|---|---|---|---|---|

| Parag Parikh Flexi Cap Fund | Flexi Cap | ~180% (~22.9% CAGR) | 115,040 | 0.63% | Rajeev Thakkar & team |

| ICICI Pru Value Fund | Value Equity | ~230% (~27.0% CAGR) | 53,750 | 0.98% | Sankaran Naren & team |

| Nippon India Multi Cap Fund | Multi Cap | ~286% (~30.0% CAGR) | 46,216 | 1.51% | Sailesh Bhan et al. |

| Kotak Large & Midcap Fund | Large+Mid Cap | ~186% (~23.6% CAGR) | 27,655 | 0.53% | Harsha Upadhyaya |

| SBI Contra Fund | Contra/Value | ~274% (~30.0% CAGR) | 46,654 | 0.75% | Dinesh Balachandran |

Data as of Oct 2025 from Value Research, AMFI, Moneycontrol. “5Y Return” shows approximate total growth and CAGR. Past performance is not indicative of future results; mutual fund investments are subject to market risks — please read all scheme-related documents carefully.

Best SIP Plans for Steady Growth and Diversification

Each of the above funds is top-rated (all are 4- or 5-star by Value Research) and fits a teacher’s SIP: no minimum SIP below ₹500–1,000, and steady long-term growth. To spread risk, you can invest in two or three of these simultaneously (for example, a flexi-cap + a multi-cap + a contra fund) without needing more than ₹1,000–2,000 total per month. The rest of your salary can stay in safer assets (emergency fund, FD, etc.), but keeping a chunk in SIPs ensures you beat inflation and build real wealth.

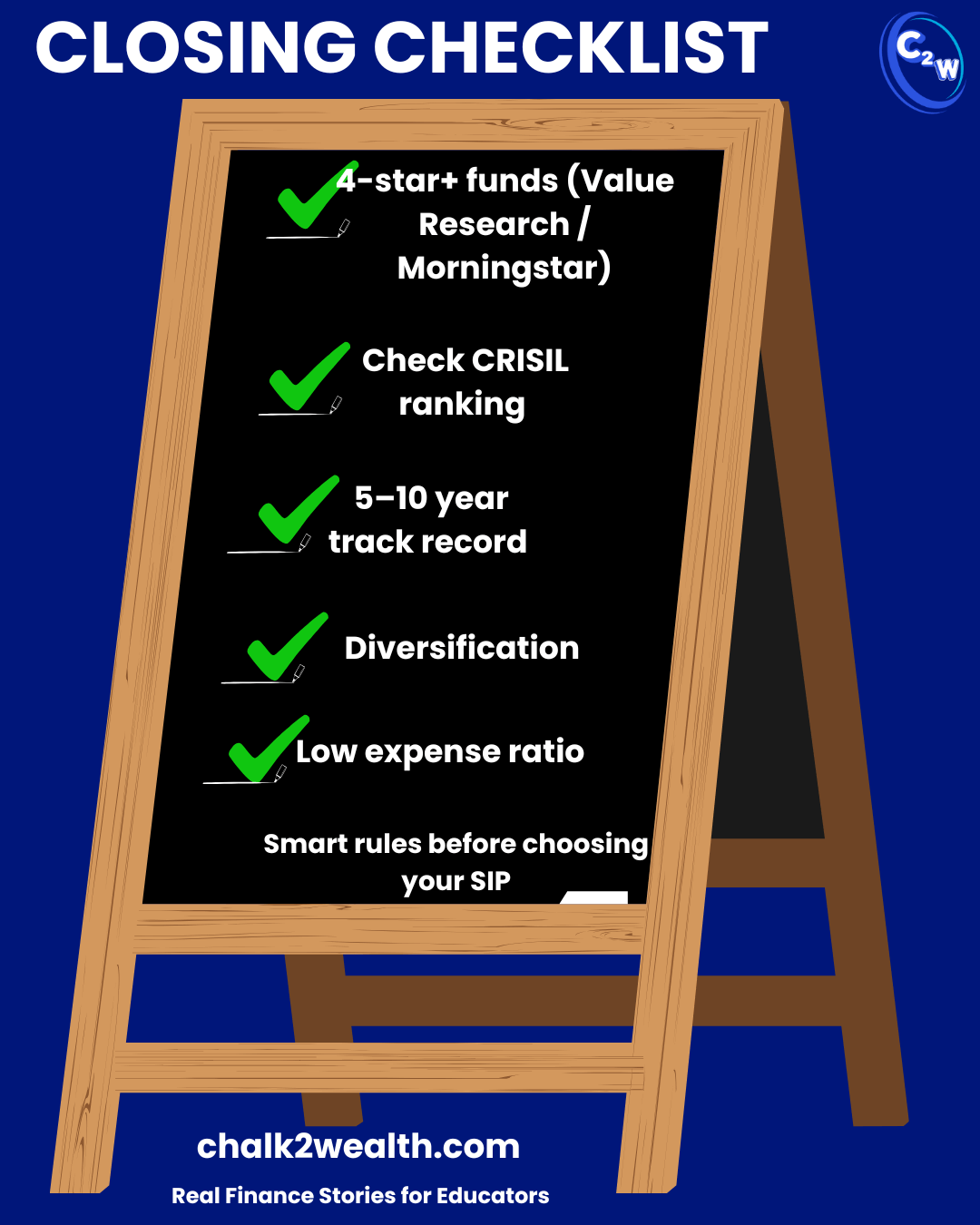

Closing Checklist: Picking the Best SIP Plans the Smart Way

- Always choose funds with at least 4-star ratings on Value Research and Morningstar.

- Double-check CRISIL rankings for added confidence in your choice.

- Prefer funds with a solid 5–10 year track record — not just last year’s hype.

- Ensure the fund is well-diversified — never put all your eggs in one basket.

- Stick to low or reasonable expense ratios — no need to pay more when you don’t have to.

👉 Remember: the Best SIP Plans aren’t just about the fund you pick, but about staying disciplined, invested, and letting compounding work its magic.

Ready to take action? Start small but start today. Even a SIP of ₹500/month in one of these Best SIP Plans can grow into a substantial corpus over 10–15 years. You can invest directly (no broker fees) via any fund house’s website or through your bank. Use chalk2wealth online SIP calculator to model your growth. The best time to invest was yesterday – the next best time is now. Commit to a monthly SIP, review your funds annually, and let compounding do the work. (Remember, markets have ups and downs; don’t panic-sell on short-term dips.) Over the next decade, this disciplined habit could turn a teacher’s modest savings into real financial security.

Disclaimer: This article is for educational purposes only and is not investment advice. All mutual fund investments are subject to market risks. Past performance does not guarantee future returns. Please read scheme documents carefully and/or consult a SEBI-registered financial advisor before investing

Best SIP Plans for Teachers – FAQs You Must Know

Which is the Best SIP Plan to Invest in 2025?

The best SIPs for 2025 based on recent 5-year performance and ratings include Parag Parikh Flexi Cap, ICICI Prudential Value Discovery, Nippon India Multi Cap, SBI Contra, and Kotak Large & Midcap. Choose 2–3 and stay invested long term

which is best sip plan in india

There is no single ‘best’ SIP fund. The right plan depends on your goals, risk, and time horizon. But consistently strong performers in India include Parag Parikh Flexi Cap, ICICI Prudential Value Discovery, and SBI Contra Fund. Focus on discipline and compounding, not chasing one fund.

Which is the Best SIP Plan for 3 Years?

There’s no one-size-fits-all best, especially for a 3-year horizon (which is relatively short for equities). But some mutual funds that have performed strongly over the past 3 years are good candidates to watch and research before investing:

- Bandhan Small Cap Fund — offered ~ 32.9% XIRR over the last 3 years as per Economic Times.

- Franklin India Opportunities Fund (Direct – Growth) — among top picks for 3-year SIPs.

- Balanced / Hybrid options like Franklin India Balanced Advantage Fund have also shown resilience, turning a ₹10,000 SIP into over ₹4.27 lakh in 3 years.

How to Choose Best SIP Plan

To pick the best SIP plan, match it to your goal, time horizon and risk appetite. Then check for consistent past performance, low expense ratio, experienced fund manager, proper diversification, and reasonable AUM

Which is the Best SIP Plan for 5 Years?

There is no universally “best” SIP, even for a 5-year horizon — but some funds with strong 5-year track records become good candidates. For example:

- Parag Parikh Flexi Cap Fund (Direct – Growth) – Flexi Cap.

- ICICI Prudential Value Fund (Direct – Growth) – Value-Style Equity.

- Nippon India Multi Cap Fund (Direct – Growth) – Multi Cap.

- Kotak Large & Midcap Fund (Direct – Growth) –

- SBI Contra Fund (Direct – Growth) – Contra/Value.