Table of Contents

ToggleLoan for Students – 5 Honest Lessons from a Family’s Financial Talk

When a Simple Question Shook Me

It was an ordinary evening. Dinner was on the table. Usha and I were discussing the school’s annual day when Dhruv, my son, looked up and asked casually:

“Papa, what’s a loan?”

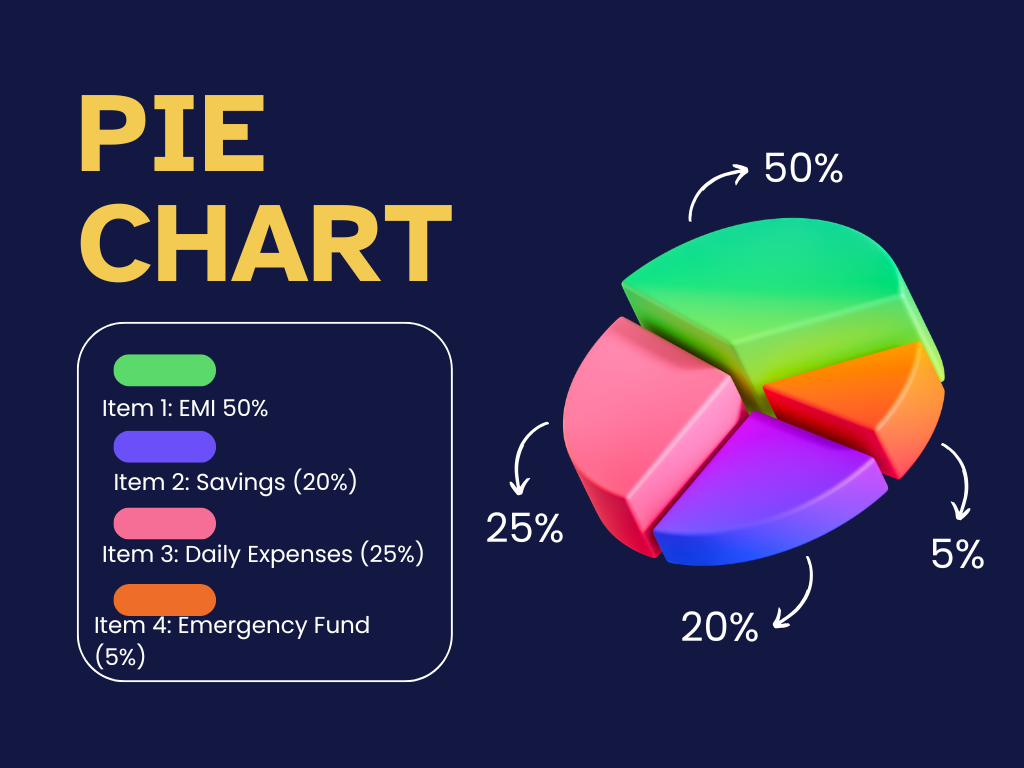

I smiled — then paused. For a second, I didn’t know what to say. I looked at him, then at Usha. My mind went quiet. Because behind that one simple question… was our entire financial story. I flashed back to February 2017 — to that night at our dining table. We were sitting with a notebook and calculator, trying to make sense of our numbers. At that point, Usha and I were managing a total loan burden of ₹70 lakh — spread across three home loans and one car loan.

Our monthly EMIs added up to ₹48,730. Despite that, we never missed a single SIP. We committed to saving ₹17,500 every month, including ₹14,000 in mutual fund SIPs and ₹3,500 for our children’s future.

But I never shared any of that with my children. Not the responsibility. Not the choices. Not the stress.

And now here I was — sitting across from Dhruv, facing that one powerful question.

“Papa, what’s a loan?”

It wasn’t just curiosity. It was a wake-up call. That innocent question made me realize something big. I had shared values, school stories, and life lessons with my kids — but I had hidden one of the most important truths — how money actually works, how we manage home loans, EMIs, and even loans for students that shape their future. That night, the dining table turned into our first honest financial classroom. And Dhruv — unknowingly — became my teacher.

2. Real Data: Why That One Question About Loan for Students Matters More Than Ever

a) Household Debt & Lifestyle Pressure

According to a June 2025 India Today report, lifestyle inflation is quietly reshaping how India’s middle class earns, spends, and saves. Bigger homes, aspirational gadgets, and quick personal loans have increased household debt — often leaving families with shrinking financial buffers and very little for emergencies.

b) EMI Load for Urban Salaried Families

A Livemint study shows that urban Indians now spend nearly one-third of their monthly income on EMIs. When so much of the family’s budget is locked into EMIs, it leaves little room for savings — and even less room for planning ahead for student loans or higher education.

c) Borrowing for Lifestyle, Not Just Assets

As reported by the Economic Times, Indian families are increasingly borrowing to fund consumption — not just long-term assets. From smartphones to vacations, credit is now being used more for comfort and less for wealth creation. In this environment, even loans for students are becoming part of the growing debt burden.

d) Student Loans on the Rise

According to India Today Education, education loans — or loans for students — are rising rapidly, especially among middle-income families in smaller towns. Why? Because as education costs grow, parents are now depending on loans to fulfill their children’s dreams.

why It Hits Home

For many Indian parents, debt has become the price of progress. But here’s the problem: If we don’t talk about it — especially with our children — we risk passing on confusion, not clarity. That’s why Dhruv’s question about loan for students wasn’t just innocent. It was important.

It reminded me that financial literacy, including how we approach home loans and loans for students, must start at home — not just in banks, textbooks, or job interviews.

3. Emotional Takeaway: From Silence to Strength — Why Talking About Loan for Students Matters

For years, I thought I was protecting my children by not talking about money. I believed — like most parents do — that letting them focus on their studies, their childhood, and their dreams was more important than sharing the burden of our financial reality. But that moment — when Dhruv asked, “Papa, what’s a loan?” — made me question that silence.

Why was I hiding something that shapes so much of our daily life? Why was I not even thinking about discussing loan for students — something that might one day shape Dhruv and Ipshita’s future?

The truth is, we hide our loans and financial stress not just from our kids — sometimes even from ourselves. Because admitting we took a loan… or struggled with EMIs… or made a mistake… feels like weakness.

And as parents, we feel a deep pressure to always appear strong.

But here’s what I learned that evening:

👉 Silence has a cost.

Emotionally, it builds distance. Financially, it delays learning. When children grow up without money conversations at home — including understanding home loans, EMIs, or even loan for students — they enter adulthood confused, not confident. They repeat the same mistakes, fall for the same traps, and carry the same stress we once did.

That evening, something shifted inside me.

I chose to answer Dhruv honestly.

I explained what a loan is.

Why we took it.

How we’re repaying it.

And how it’s okay to borrow — if we borrow with purpose, discipline, and a plan.

It was no longer about being ashamed. It was about being accountable. Transparent. Human.

And in that conversation, I saw something powerful in Dhruv’s eyes — respect, not worry. He didn’t panic. He listened. He asked more questions.

And that’s when I realized:

Financial honesty doesn’t burden a child — it builds a stronger, wiser one.

That evening, I didn’t just teach my son about loans. I taught him about the future. I taught him about responsibility. And maybe, I quietly opened the door for the day when Dhruv or Ipshita might take a loan for students — with full awareness and confidence.

That night taught me something else too:

Openness is strength — not shame.

4. What I Told My Son About Loans — A Real Conversation

After that long pause — and after all those thoughts flashing through my head — I finally looked at Dhruv and said:

“Beta, a loan is when we borrow money from someone — usually a bank — and promise to return it little by little, every month, with some extra added. That extra is called interest.”

He looked curious. “Why would anyone take money they don’t already have?”

I smiled.

“Sometimes we need to — to buy a house, to pay for school, or even to support higher studies in the future. Like when Mummy and Papa bought this home… we didn’t have ₹70 lakh lying around. But we had a dream. And we had a plan. So we took a loan, and we’re returning it bit by bit.” He nodded slowly, still processing.

I added gently, “And one day, you or Ipshita might also take a loan — maybe a loan for students if you study further. That’s perfectly fine. A loan can help you grow, but only if you borrow with discipline and a clear reason.”

Then I showed him a page from our old notebook — the one where Usha and I had listed our EMIs and savings back in 2017.

“This is how we’ve been managing. Even when our loans were big, we never stopped saving — especially for you and your sister.”

He didn’t say much. But I could see something change in his expression — from innocent wonder to quiet understanding.

That night, I didn’t use big finance words. I didn’t talk about ROI, credit scores, or amortization schedules. I just told him the truth — with honesty and heart.

And maybe that’s all kids really need to hear.

Because if we can explain loans — even loan for students — to our children with love and clarity, we’re not just raising smart kids — we’re raising future-ready adults.

5. Five Things I Realized That Day — Lessons I’ll Never Forget

That one question — “Papa, what’s a loan?” — changed more than just our dinner conversation. It quietly rewrote something inside me.

Here’s what I took away from that powerful moment:

1. Hiding Financial Truths Doesn’t Protect Our Children — It Delays Their Growth

For years, I thought I was shielding my children from stress. But in doing so, I had also kept them away from essential life lessons.

Dhruv wasn’t scared by the idea of a loan. He was curious. Ready.

I realized: kids don’t need protection from reality — they need gentle guidance through it. Whether it’s a home loan, a car loan, or a loan for students in the future, they deserve to know how these things work.

2. Financial Literacy Begins at Home — Not in School

Our schools rarely teach children about EMIs, budgeting, or the responsibility that comes with borrowing. If I want Dhruv and Ipshita to grow up financially confident, I can’t wait for a textbook or a syllabus.

That responsibility begins with me, at home — through honest, small conversations like this.

3. Debt is Not a Dirty Word — It’s a Tool

That evening taught me to stop fearing the word “loan.” We borrowed to build a home. We borrowed with purpose. We borrowed with a plan. The mistake isn’t borrowing — the mistake is borrowing blindly or hiding it like a secret.

Even a loan for students can be a powerful tool — if it’s taken thoughtfully, managed carefully, and discussed openly.

4. Honest Conversations Build Deeper Bonds

After I explained the loan to Dhruv, I felt something shift inside me. I felt lighter. Stronger. More connected to him. That evening wasn’t about numbers. It was about trust. And sometimes, all it takes is one honest moment to bring families closer.

5. My Children Deserve More Than Comfort — They Deserve Clarity

We work so hard to give our children good food, good clothes, good schools… But what about giving them good understanding?

That night taught me:

Teaching them what we can afford matters as much as what we buy.

Because when they grow up, they won’t just remember what we gave them — they’ll remember what we taught them.

And maybe, when Dhruv or Ipshita think about taking a loan for students someday, they’ll make that decision with courage, knowledge, and confidence. That dinner table moment was brief. But its impact will last a lifetime.

Because sometimes, children don’t just ask questions — they open doors we didn’t even know we had locked.

6. Tips for Parents: How to Talk to Kids About Money, Home Loans, and Loan for Students (Without Overwhelming Them)

Talking to children about money doesn’t have to be complicated. It just needs to be honest, simple, and age-appropriate.

Whether it’s about daily savings, home loans, or even loan for students, these small conversations can shape their future confidence with money.

Here are 5 easy ways to begin:

1. Start with Real Life

Use daily moments — like shopping, paying bills, or visiting the bank — to explain what money does. Example: When paying your home loan EMI, say, “We are returning the loan bit by bit every month.”

2. Talk About Loans Honestly (Including Home Loans and Loan for Students)

Explain that borrowing isn’t bad — but it comes with responsibility. Use stories like: “We took a home loan to buy this house. One day, you might take a loan for students if you study further. Both are fine if you plan and repay carefully.”

3. Give Age-Appropriate Lessons

- Age 5–8: Needs vs. Wants, piggy bank, simple coins

- Age 9–13: Goal jars, savings habits, basic budgets

- Age 14+: Home loans, EMIs, loan interest calculator examples, student loans, credit vs. debit

4. Involve Them in Budgeting

Let them help decide how to spend ₹100 at a kirana store. Give them a small allowance and introduce a “save/spend/give” split system. You can even show them how to use a simple loan interest calculator to understand how borrowing works in real life.

5. Share Your Mistakes Too

Talk openly about financial regrets, not just successes. Explain if you took a home loan without comparing options or miscalculated loan interest. Let them see you learning — they’ll respect your honesty and grow smarter because of it.

Remember:

The goal is not to make your child a finance expert.

The goal is to make them comfortable with money conversations — about saving, home loans, EMIs, loan for students, and everything in between.

Remember: The goal isn’t to make your child a finance expert. It’s to make them comfortable with money conversations — early and often.

Have a money story in your family? Share it.

👇 Comment below or message me directly on WhatsApp.

Let’s make money talk normal — not taboo — in every Indian home. Because the earlier we talk, the stronger they walk.

Need help starting that conversation with your kids?

[Download our FREE guide: “How to Talk to Kids About Money” — Only from Chalk2Wealth]

It’s not just about what money can buy —It’s about helping them understand what it can protect, build, and free.